The cryptocurrency space suffered a meltdown in 2022.

Welcome to the club!

During a brutal year for markets, it’s hard to find a sector that did not get hammered last year.

However, what does distinguish cryptocurrencies from other sectors is that there were significant internal factors that contributed to the plunge in cryptocurrency valuations.

Call that the end of the era for Crypto 1.0. “Bugs” were uncovered (some of which were major).

But a new-and-improved version of the cryptocurrency model is already being rolled out. The tokenization of assets era has arrived.

One company to watch as the tokenization of assets acquires increasing importance is The INX Digital Company (NEO:INXD/OTC:INXDF).

Big opportunity in the cryptocurrency sector?

Cryptocurrencies appear to have bottomed and look to be already entering another major up-leg, as Bitcoin is once again strongly rallying.

That might not be enough for more discriminating investors or simply those with a lower tolerance for risk. For these investors, nothing less than the cleanest shirt in the industry could lure them back to this space.

Meet INX Digital, owner of “the cleanest shirt in the industry.”

When The Market Herald spoke with Deputy CEO and Chief Operating Officer Itai Avneri, he explained the unique aspects of INX. Then he used that phrase to summarize the distinction between INX and its peers in the cryptocurrency industry.

What makes INX’s exchange (and business model) unique within the cryptocurrency industry?

It starts with one word: regulation.

In our chat with the management of INX, this was where the conversation began.

As Shy Datika, CEO and Co-Founder of The INX Digital Company (or just “INX”), originally surveyed the cryptocurrency space, he realized this was the future of finance.

However, while many other players in cryptocurrencies were happy to bask in the “independence” of cryptos (from the mainstream financial system), and after years at the top of the traditional financial industry, he vividly predicted the clear risk.

Five years before the FTX exchange and company blew up amid poor governance and scandalous accounting, INX chose a different path. Shy Datika went through the laborious process of making INX (and its trading platform) a fully-regulated and highly-transparent cryptocurrency/security token company.

The company is “a bridge” between traditional and digital economies

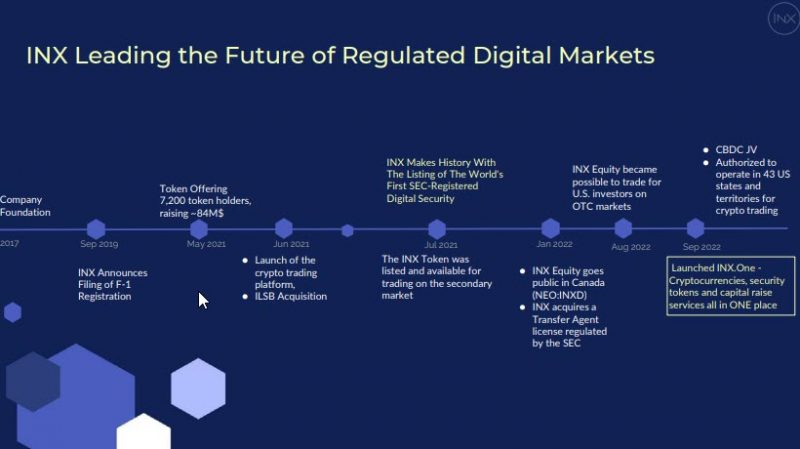

Founded in 2017, INX’s prescription for addressing perceived risks and vulnerabilities with digital assets has two components: a regulated, structured, and transparent business model and security tokens.

Put together, today, INX offers investors the only “regulated decentralized platform” for the trading of digital securities. It issued “the first SEC security token to IPO in the blockchain,” and that is now available for the general public on the INX Platform

While INX may be flying under the radar of many investors, its new-and-improved business model for the trading of cryptocurrencies and other financial assets has caught the attention of both regulators and sophisticated observers in the business media.

This September 22, 2022, article from The Wall Street Journal captures their reaction.

Building a Bridge Between Crypto and the Regulators

A company called INX is building a marketplace for trading cryptocurrencies and digital assets that comply with existing securities laws.

This week, the company launched a new version of its exchange, dubbed INX.One that lists both cryptocurrencies and “security tokens” for trading. It also allows companies that have registered their security tokens with the SEC to offer them for sale, kind of like an initial public offering.

Of perhaps greater importance to investors, in a separate article SEC Chairman Gary Gensler essentially endorsed the INX business model, noting that it was aligned with the SEC’s own vision for cryptocurrency trading.

This high-profile U.S. coverage is all the more notable given that INX is a Canadian-listed small cap with (at present) a market cap of only CAD$34 million.

For most investors, this will beg an important question: what is a security token?

Deputy CEO Avneri explained the important distinction between “a security token” and a cryptocurrency token:

Raising capital by issuing a Security token encapsulates many advantages for the issuer as well as the investor – security tokens are a non-dilutive instrument, investors can participate with crypto and fiat funds, issuers can tokenize a fraction of the business and make it more accessible for a wider audience and once listed for the secondary market it is available for trading 24/7 365 days a year.

A security token is not some recent statutory invention derived from cryptocurrencies. Rather, this financial instrument was originally defined and created all the way back in 1933.

Tokenization of assets projected to grow by 50X

For The INX Digital Company (and investors), the most important distinction between security tokens and cryptos – and the primary difference between INX and its peers – is how capital appreciates.

With security tokens, capital appreciation is derived from the internal profits of the issuing provider. Appreciation comes in the familiar corporate model: from improved operating efficiencies and/or corporate growth.

This also permits the issuance of corporate dividends to token holders/consumers based on these internal profits.

In contrast, “independent” cryptocurrencies require a steadily rising (infinitely rising?) cryptocurrency price in order to continue to generate capital appreciation. For many sober investors, this “model” bears disturbing similarities to a Ponzi scheme.

As previously noted by The Wall Street Journal, the INX.One, the INX trading platform is more than a platform for the company’s own proprietary security tokens.

INX.One holds transfer agents, broker-dealers, and ATS licenses under the SEC and FINRA, as well as the majority of money transmitter licenses that allow for cryptocurrency trading.

While it hosts multiple carefully selected and vetted cryptocurrencies, it now enables others to issue security tokens and raise capital by providing them with a nose-to-tail solution, including a licensing umbrella, technology, marketing, compliance/ KYC services, and more – Token as a Service.

INX has already launched four other security tokens, each with its own unique niche of traders/enthusiasts. The most recent addition here was the hosting of the TurnCoin token, announced on January 31, 2023.

The equation here is pretty simple. If you’re an entity that wants to create its own security token and raise capital, but you don’t want to also have to create/launch your own exchange to host it, INX is your solution.

However, this is only the starting point for the business model.

INX’s (regulated) trading platform can be used for trading other financial assets, such as bonds. It can also be used to facilitate debt restructurings and even trade other types of assets – like real estate.

Deputy CEO Avneri describes INX as a marriage between “cefi” (centralized finance) and “defi” (decentralized finance).

Investors may look at INX’s tokenization of assets as representing the best of both worlds.

“Asset tokenization” is projected to grow by a factor of 50 to $16 trillion by 2030 – a mere seven years from now. INX is positioned in the middle of this mammoth opportunity as a regulatory “bridge.”

INX is already preparing for CBDCs

INX is not wasting any time in leveraging its status as “a bridge between digital assets and the regulators.” Also in the works is a “historic partnership” with Swiss-based SICPA, announced on December 20, 2022. SICPA is “a global leader in authentication, revenue realization, and secure traceability solutions.”

The joint venture combines both blockchain infrastructure and “digital cash technologies” to create a platform able to trade the widely-telegraphed Central Bank Digital Currencies (CBDCs) that are already at least on the drawing board of most central banks.

“The first-ever SEC-regulated digital asset trading platform for both cryptocurrencies and security tokens.” For a company with a market cap of only CAD$34 million, clearly, INX is punching well above its weight class.

INX is attractively priced for investors

Like many quality companies, (at the moment) INX’s valuation practically shouts “undervalued.” Beyond its positioning as a leader in the tokenization of assets, INX is asset-rich in relation to its lean valuation.

In its Q3 2022 results (November 14, 2022), The INX Digital Company reported cash and cash equivalents of CAD$25.8 million, plus an additional CAD$8.7 million in short- and long-term investments. The company is basically trading at cash.

INX also maintains a reserve fund of CAD$36.0 million, entirely separate and distinct from its internal corporate cash position.

Well-capitalized, undervalued, and a regulatory visionary in the cryptocurrency space that is at the forefront of the tokenization of assets. INX Digital is very attractively priced for investors looking to shop for bargains among cryptocurrency companies.

But don’t take too long to do your due diligence.

Investors who follow cryptocurrencies will be well-aware that Bitcoin has been on a torrid rally to begin 2023. It’s now risen by more than 50% from its bottom in late-2022.

Bitcoin remains the Big Dog in the cryptocurrency space. If this current rally continues, it can/will single-handedly float all boats in the cryptocurrency industry – just as it has in previous major rallies.

This means that The INX Digital Company is unlikely to remain at such a bargain price for long.

With Bitcoin rallying, CBDCs on the way, and “security tokens” poised to assume a prominent role in the tokenization of assets, INX is a hot opportunity for any serious investor in the cryptocurrency space.

DISCLOSURE: This is a paid article by The Market Herald.