- Benchmark (BNCH) has drilled up to 56.65 g/t gold and 79.75 g/t silver on its Lawyers Project in B.C.

- The new results are defining strong continuity of gold and silver mineralization over 50 m with the system remaining open along strike

- They may also add significant higher-grade gold and silver ounces in an updated mineral resource estimate

- The company has planned new drill holes to potentially extend the continuity along strike to the northwest and southeast

- Benchmark Metals is a Canadian-based gold and silver exploration company

- Benchmark (BNCH) is unchanged trading at $1.02 per share

Benchmark (BNCH) has drilled up to 56.65 g/t gold and 79.75 g/t silver on its Lawyers Project in B.C.

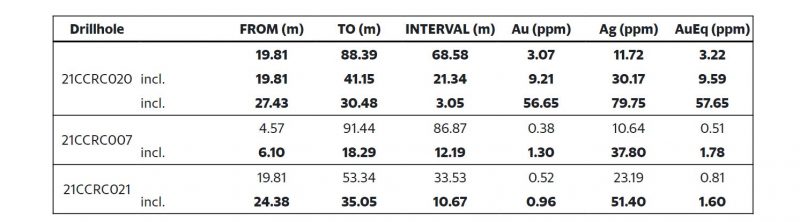

The 3.05 m section stems from infill drilling at the Cliff Creek Mid Zone within 68.58 m core length of 3.07 g/t gold and 11.72 g/t silver in drill hole 21CCRC020.

Infill drilling focused on the Mid Zone’s east side, intersecting near-surface high-grade and bulk-tonnage mineralization in an area thought to be weakly to modestly mineralized based on historical drilling.

This latest discovery indicates:

- Conversion of previously modelled waste in the resource model to mineralized domains

- The ability to expand the pit shells as the resource grows

- Near-surface high-grade mineralization generates flexibility and potential for higher-grade starter pits

The new results are defining strong continuity of gold and silver mineralization over 50 m with the system remaining open along strike. They may also add significant higher-grade gold and silver ounces in an updated mineral resource estimate.

The company has planned new drill holes to potentially extend the zone along strike to the northwest and southeast.

Drill results summary from the Cliff Creek Mid Zone

John Williamson, Benchmark’s CEO, stated,

“The Cliff Creek Mid Zone is now not only expanding at depth but also to the east with higher-grade gold and silver mineralization. The new gold-silver mineralization begins near surface and was previously unrecognized in this area. This type of near-surface higher-grade mineralization will have a positive impact on the preliminary economic analysis by delivering early year’s material in the production schedule. Benchmark has planned additional diamond drilling to focus on expanding this zone.”

Benchmark Metals is a Canadian-based gold and silver exploration company.

Benchmark (BNCH) is unchanged trading at $1.02 per share as of 11:53 am ET.