- Baroyeca (BGS) has assayed up to 708 g/t AgEq in phase 2 drilling at its Atocha Project

- The results stem from the program’s initial drill hole with assays pending for hole two

- The company is developing new targets to the south in pursuit of additional vein zones

- Baroyeca Gold & Silver operates high-grade silver and gold projects in Colombia

- Baroyeca (BGS) is down by 4.76 per cent trading at $0.20 per share

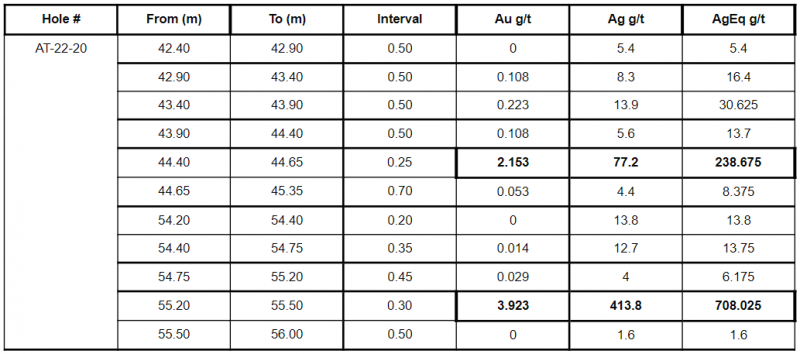

Baroyeca (BGS) has assayed up to 708 g/t AgEq in phase 2 drilling at its Atocha Project.

The results stem from the first hole (AT-22-20) of the drilling program on the Colombian high-grade silver project. The drill hole intersected two stacked veins roughly ten metres apart from each other.

With assays pending, the company’s second drill hole intersected the same vein zones as AT-22-20. It has started a third drill hole as a step-out to the northeast.

Drilling is focused on a new target where 2021 chip samples on outcropping veins returned values as high as 1,587 AgEq.

“We are pleased to see more parallel structures following wide vein corridors in our first two holes drilled in this new area, another discovery on the Atocha property,” stated Raul Sanabria, President of Baroyeca. “Assay results of up to almost three-quarters of a kilo per tonne silver equivalent makes a good start to the phase 2 program.”

“The next drill holes will test the continuity of the structure along strike while we develop more drill targets to the south, where we found at least three more parallel vein zones within short distance,” he added.

Drill core assay results

Baroyeca Gold & Silver operates high-grade silver and gold projects in Colombia.

Baroyeca (BGS) is down by 4.76 per cent trading at $0.20 per share as of 11:13 am EST.