- Ascot Resources (AOT) has posted the maiden drill results from its Premier property in British Columbia

- The company was drilling on the western extension of the property, near the company’s active open-pit gold mine

- The results included 20.06 grams per tonne gold over 3.23 metres, and 9.21 grams per tonne gold over 6 metres

- The company is drilling a series of fences, which drill down before drilling a series of lateral step outs

- Ascot Resources (AOT) is down one per cent and is trading at C$1.09 per share at 1:45 pm EDT

Ascot Resources (AOT) has hit 20.06 grams per tonne gold across 3.23 metres while drilling at its Premier property in British Columbia.

Other highlight results included 9.21 grams per tonne gold over six metres and 16.25 grams per tonne from a grab sample on the property.

The company started drilling the Premier West deposit at the start of June, in an effort to expand its resource estimate for the property. The Premier West deposit is just west of the active Premier open pit mine.

Thus far the company has divined two kilometres of strike west of the pit, extending from the road that leads toward the mine.

The company designed its drilling program to test the largest strike length it could from the same drilling holes. To that end, Ascot has constructed its drilling pads on set spots along a fence where it can drill step out drills to test mineralization laterally once it has drilled to depth.

These drills have found a trend of mineralization that dips down steeply by between 80 to 100 metres of strike.

Derek White, CEO and President of Ascot Resources, said he was pleased with the initial results from the Premier deposit.

“As we move to re-starting production, these potential resources have obvious implications for extending the mine life at low cost.

“We are mobilising a second rig in the beginning of august in order to accelerate drill testing of our exciting targets.

“We continue to be impressed by the potential for discovery of new deposits on our landholdings.

“Initial drilling has been focused on lower elevation targets and as the weather conditions improve, we will drill at higher evaluations, including our high-grade silver targets at Silver Hill,” he said.

Ascot Resources (AOT) is down one per cent and is trading at C$1.09 per share at 1:45 pm EDT.

VANCOUVER, British Columbia, July 29, 2020 (GLOBE NEWSWIRE) — Ascot Resources Ltd (TSX: AOT; OTCQX: AOTVF) (“Ascot” or the “Company”) is pleased to announce high gold grades in the first seven drill holes (1,930 metres) of the 2020 season. The drill site is strategically located to the west of the Premier deposit (“Premier West”), potentially adding to existing resources outlined in the feasibility study. The significance of this prospective corridor is further highlighted by high gold grades in surface grab samples even further along strike to the west at Hope, Cascade Creek and Woodbine (see Figure 1).

Highlights of this release include:

- 20.06g/t Au over 3.23m in hole P19-2193

- 9.21g/t Au over 6.00m in hole P19-2183

- 16.25g/t Au in a grab sample from Cascade Creek

In early June the Company started drilling on the area west of the Premier open pit. Mineralization occurs in several areas at surface over a strike length of nearly 2 kilometres, namely at the Premier mill road, the Hope zone at the Granduc road, the Cascade Creek valley and the Woodbine prospect.

Derek White, President and CEO of Ascot commented, “We are pleased with these initial high-grade results close to the Premier deposit. As we move to re-starting production, these potential resources have obvious implications for extending the mine life at low cost. We are mobilizing a second rig in the beginning of August in order to accelerate drill testing of our exciting targets. We continue to be impressed by the potential for discovery of new deposits on our landholdings. Initial drilling has been focused on lower elevation targets and as the weather conditions improve, we will drill at higher elevations, including our high-grade silver targets at Silver Hill.”

Drill Results

Ascot designed a drill program to explore the area west of the Premier mineralization in sufficiently tight spacing to potentially add to the resources in this area. To that end, six fences of drill holes were designed from one strategically positioned pad for the systematic step outs. To date four fences of holes have been completed and this release summarizes the results from the first seven drill holes on fence one and two. Drilling of the remaining holes is continuing with samples already in the laboratory for analysis. Drill hole results are slower than anticipated due to Covid protocols at the lab.

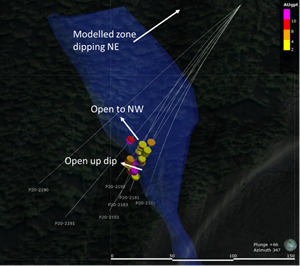

Figure 2 illustrates the layout of the drill holes relative to the projected trend of the mineralization. The drill holes outline a steeply dipping zone of mineralization with a vertical extent of approximately 80-100 metres. Mineralization is open towards the surface and additional fences of drill holes are currently testing the continuation to the west. The drill results are summarized in Table 1 and the pad location is specified in Table 2.

Table 3 summarizes the results from eleven grab samples that were collected during prospecting following the trend of mineralization to the west. The Hope zone is an outcrop at surface that is offset to the south from the main trend of mineralization coming from the Premier pit (see Figure 1). A high-grade sample was also collected at the eastern edge of Cascade Creek and several mineralized samples were collected on the western side of Cascade Creek in the Woodbine (“WB”) area. The Company plans to follow up these exciting surface results with drilling as the field season progresses.

Figure 1 Image of the Premier mine area showing the location of the drill pad and prospects described in this release.

https://www.globenewswire.com/NewsRoom/AttachmentNg/d47e6eb5-228b-4f1a-bd96-e8aca625cb11

Table 1 Summary of exploration drill results from Premier West

| Hole # | pad | azimuth/dip | From (m) | To (m) |

Width (m) |

Au (g/t) |

Ag (g/t) |

| P20-2181 | PW-1 | 235/-63 | 205.00 | 205.95 | 0.95 | 7.11 | 10.8 |

| and | 235.00 | 237.00 | 2.00 | 6.19 | 23.4 | ||

| and | 255.80 | 257.80 | 2.00 | 3.31 | 4.9 | ||

| P20-2182 | PW-1 | 235/-67 | 263.80 | 265.80 | 2.00 | 0.85 | 64.8 |

| P20-2183 | PW-1 | 235/-55 | 199.80 | 211.75 | 11.95 | 3.23 | 12.4 |

| incl. | 200.80 | 201.80 | 1.00 | 8.85 | 19.4 | ||

| incl. | 210.80 | 211.75 | 0.95 | 11.80 | 14.0 | ||

| and | 223.70 | 225.70 | 2.00 | 11.55 | 11.4 | ||

| incl. | 224.70 | 225.70 | 1.00 | 21.70 | 18.9 | ||

| and | 231.90 | 237.90 | 6.00 | 9.21 | 6.9 | ||

| incl. | 234.90 | 235.90 | 1.00 | 29.20 | 16.1 | ||

| P20-2190 | PW-1 | 235/-46 | no significant intercept | ||||

| P20-2191 | PW-1 | 220/-48 | 168.40 | 171.85 | 3.45 | 13.33 | 78.6 |

| incl. | 170.60 | 171.85 | 1.25 | 28.50 | 172.0 | ||

| P20-2192 | PW-1 | 220/-55 | 201.60 | 207.90 | 6.30 | 5.29 | 107.0 |

| incl. | 206.90 | 207.90 | 1.00 | 9.23 | 114.0 | ||

| P20-2193 | PW-1 | 220/-60 | 199.20 | 215.20 | 16.00 | 2.79 | 13.6 |

| incl. | 213.20 | 215.20 | 2.00 | 9.66 | 12.2 | ||

| and | 227.50 | 230.73 | 3.23 | 20.06 | 39.7 | ||

| incl. | 227.50 | 228.55 | 1.05 | 32.30 | 63.5 | ||

True width is estimated to be 70-90% of reported intervals. The drill holes were targeted perpendicular to the expected zone orientation.

Table 2 Drill pad location

| Pad # | UTM N | UTM E | Elevation(masl) | Hole no. |

| PW-1 | 6212682 | 436162 | 321 | 2181-2183, 2190-2193 |

Table 3 Grab sample results from the Hope zone and the Woodbine prospect

| Location | Easting | Northing | Au (g/t) | Ag (g/t) | Cu (%) | Pb (%) | Zn (%) |

| Hope1 | 436050 | 6212793 | 3.80 | 95.3 | 0.27 | 0.69 | 2.46 |

| Hope2 | 436043 | 6212787 | 3.89 | 169.0 | 0.46 | 1.26 | 4.41 |

| Hope3 | 436045 | 6212790 | 0.39 | 194.0 | 0.56 | 2.21 | 16.70 |

| Hope5 | 436075 | 6212768 | 16.25 | 205.0 | 0.42 | 0.44 | 8.56 |

| Hope6 | 436098 | 6212770 | 1.51 | 82.6 | 0.02 | 2.84 | 1.79 |

| Hope6B | 436098 | 6212770 | 0.34 | 51.7 | 0.00 | 1.78 | 0.99 |

| CascadeCreek1 | 435931 | 6212992 | 8.52 | 114.0 | 0.84 | 0.77 | 1.79 |

| WB Muck Pile | 435629 | 6213005 | 0.59 | 129.0 | 0.40 | 0.40 | 18.20 |

| WB Grab 1 | 435456 | 6212935 | 3.57 | 65.5 | 0.01 | 0.90 | 1.23 |

| WB Grab 2 | 435456 | 6212934 | 3.30 | 124.0 | 0.03 | 2.23 | 3.07 |

| WB Grab 3 | 435456 | 6212933 | 3.69 | 136.0 | 0.03 | 2.04 | 3.13 |

Figure 2 Image of a 3D section showing the layout of the drill holes reported in this release relative to the northeast dipping modeled zone that is being targeted. The drill intercepts suggest that there might be two parallel mineralized zones but the general trend of the mineralization is confirmed by the new drill holes.

https://www.globenewswire.com/NewsRoom/AttachmentNg/28a807c6-033e-4996-a285-a136b96f4f9a

Figure 3 Image showing a 1.5cm particle of native gold in drill core from hole P20-2183.

https://www.globenewswire.com/NewsRoom/AttachmentNg/3b328ff5-da1e-4a0a-8907-28d568dbc336

COVID-19 Safe Operations Protocols

In response to the COVID-19 pandemic, Ascot has developed and adopted safe operations protocols based on the recommendations of the British Columbia Public Health Officer and guidance from the Association for Mineral Exploration BC. The Ascot Covid plan is posted on the Company website at www.ascotgold.com. The Company has proactively mandated self-quarantine protocols for any individuals displaying any sign of potentially Covid related symptoms including those who have been in direct contact with such persons. Testing has been made available to anyone displaying symptoms.

Quality Assurance/Quality Control

Lawrence Tsang, P. Geo., the Company’s Senior Geologist provides the field management for the Premier exploration program. John Kiernan, P. Eng., Chief Operating Officer of the Company is the Company’s Qualified Person (QP) as defined by National Instrument 43-101 and has reviewed and approved the technical contents of this news release.

ON BEHALF OF THE BOARD OF DIRECTORS OF

ASCOT RESOURCES LTD.

“Derek C. White”, President and CEO

For further information contact:

Kristina Howe

VP, Investor Relations

778-725-1060 / [email protected]

About Ascot Resources Ltd.

Ascot is a Canadian-based exploration and development company focused on re-starting the past producing historic Premier gold mine, located in British Columbia’s Golden Triangle. The Company continues to define high-grade resources for underground mining with the near-term goal of converting the underground resources into reserves, while continuing to explore nearby targets on its Premier/Dilworth and Silver Coin properties (collectively referred to as the Premier Gold Project). Ascot’s acquisition of IDM Mining added the high-grade gold and silver Red Mountain Project to its portfolio and positions the Company as a leading consolidator of high-quality assets in the Golden Triangle.

For more information about the Company, please refer to the Company’s profile on SEDAR at www.sedar.com or visit the Company’s web site at www.ascotgold.com, or for a virtual tour visit www.vrify.com under Ascot Resources.

The TSX has not reviewed and does not accept responsibility for the adequacy or accuracy of this release.

Cautionary Statement Regarding Forward-Looking Information

All statements, trend analysis and other information contained in this press release about anticipated future events or results constitute forward-looking statements. Forward-looking statements are often, but not always, identified by the use of words such as “seek”, “anticipate”, “believe”, “plan”, “estimate”, “expect” and “intend” and statements that an event or result “may”, “will”, “should”, “could” or “might” occur or be achieved and other similar expressions. All statements, other than statements of historical fact, included herein are forward-looking statements, including statements in respect of the closing of the Private Placement and the use of proceeds. Although Ascot believes that the expectations reflected in such forward-looking statements and/or information are reasonable, undue reliance should not be placed on forward-looking statements since the Ascot can give no assurance that such expectations will prove to be correct. These statements involve known and unknown risks, uncertainties and other factors that may cause actual results or events to differ materially from those anticipated in such forward-looking statements, including the risks, uncertainties and other factors identified in the Ascot’s periodic filings with Canadian securities regulators, and assumptions made with regard to: the estimated costs associated with construction of the Project; the timing of the anticipated start of production at the Projects; the ability to maintain throughput and production levels at the Premier Mill; the tax rate applicable to the Company; future commodity prices; the grade of Resources and Reserves; the ability of the Company to convert inferred resources to other categories; the ability of the Company to reduce mining dilution; the ability to reduce capital costs. Forward-looking statements are subject to business and economic risks and uncertainties and other factors that could cause actual results of operations to differ materially from those contained in the forward-looking statements. Important factors that could cause actual results to differ materially from Ascot’s expectations include risks associated with the business of Ascot; risks related to exploration and potential development of Ascot’s projects; business and economic conditions in the mining industry generally; fluctuations in commodity prices and currency exchange rates; uncertainties relating to interpretation of drill results and the geology, continuity and grade of mineral deposits; the need for cooperation of government agencies and indigenous groups in the exploration and development of properties and the issuance of required permits; the need to obtain additional financing to develop properties and uncertainty as to the availability and terms of future financing; the possibility of delay in exploration or development programs and uncertainty of meeting anticipated program milestones; uncertainty as to timely availability of permits and other governmental approvals; risks associated with COVID-19 including adverse impacts on the world economy, construction timing and the availability of personnel; and other risk factors as detailed from time to time and additional risks identified in Ascot’s filings with Canadian securities regulators on SEDAR in Canada (available at www.sedar.com). The timing of future economic studies; labour disputes and other risks of the mining industry; delays in obtaining governmental approvals, financing or in the completion of Project as well as those factors discussed in the Annual Information Form of the Company dated March 13, 2020 in the section entitled “Risk Factors”, under Ascot’s SEDAR profile at www.sedar.com. Forward-looking statements are based on estimates and opinions of management at the date the statements are made. Ascot does not undertake any obligation to update forward-looking statements.