- Antioquia Gold (TSXV:AGD) has released production results from its Cisneros mining operation for the month of May

- The junior miner’s production figures grew to 1,446 troy ounces, up from 1,349 troy ounces last month

- However, the company was forced to scale back production after it ran out of water supply during the month

- Despite the interruption, the site managed to produce the best grade head of its lifetime during the month, with a 97 per cent return rate

- Antioquia Gold (AGD) is up 20 per cent and is trading at C$0.03 per share

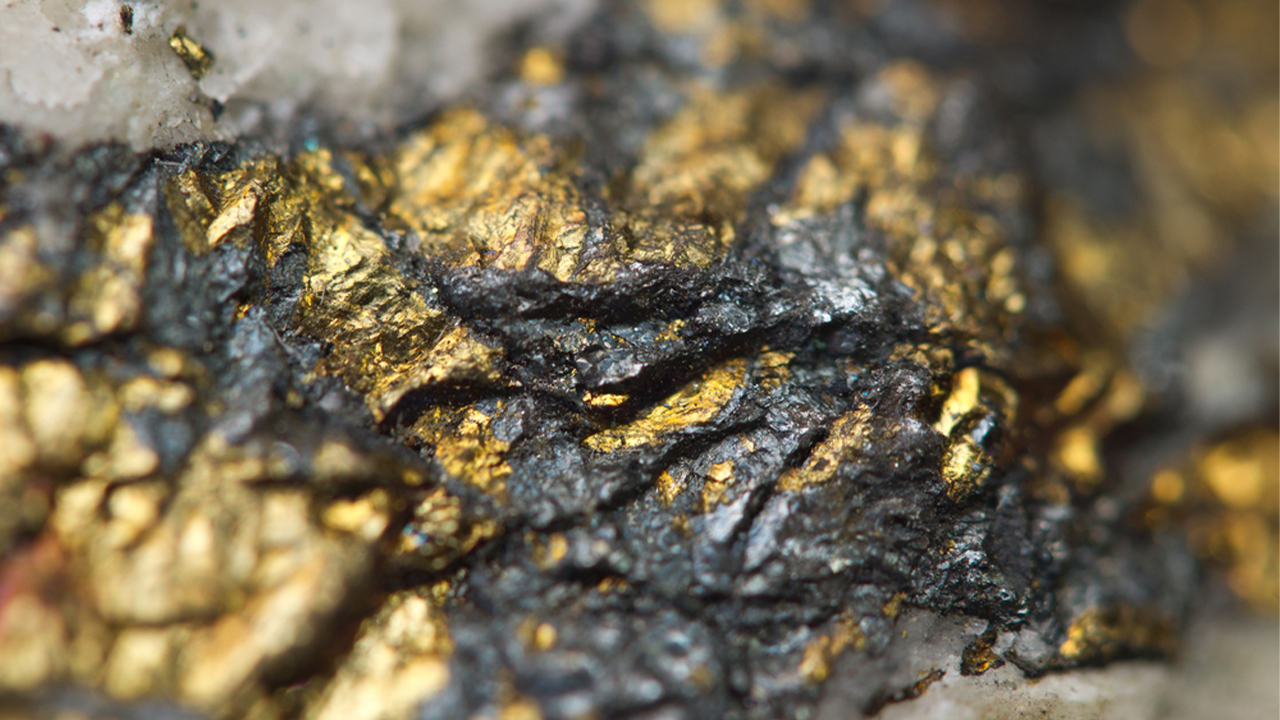

Antioquia Gold (TSXV:AGD) has released production results from its Cisneros mining operation for the month of May.

The Calgary based junior miner produced 1,446 troy ounces of gold during the month, up from 1,349 troy ounces last month.

The average tonnage per day sat at 357 tonnes, as the company’s average head grade grew to its best ever results with a 97 per cent return rate.

The total minerals processed sat at 11,077 tonnes for the month, slightly down on April’s result of 13,329 tonnes.

The company stated difficulties with securing its water supply to the site caused a temporary production decrease in the daily processing rate.

The company stated it has now overcome those problems, constructing a new water pipeline to the site and negotiating a greater water concession from the Colombian Government.

The company is closing in on finishing its expansion to a 1,200 tonne per day production facility. The company’s been tracking along at roughly a third of that capacity thus far.

The scheduled completion date for the plant is Mid-July, which should see a substantial production bump.

The exploration program on the site has also been cracking along, with 20 drill holes completed on shears around the Cisneros mine.

Results from that drilling program include 5.4 meters of intersection grading at 17.31 grams per tonne, alongside another result of 14 metres of intersection grading at 5.11 grams per tonne gold.

President and CEO of Antioquia Gold, Gonzalo de Losada said the company was improving gold production month by month.

“This, added to the excellent results of the recent exploration programs, allows us to project a solid growth for the company in the short term,” he said.

Antioquia Gold (AGD) is up 20 per cent and is trading at C$0.03 per share at 2:15 pm EDT.