The TSX, TSXV, CSE and NEO exchanges list over 4,000 companies, a daunting number for any investor to sort through.

Parsing prospective opportunities from also-rans begins with narrowing down your investable universe, leaving only companies whose operations mark a clear path forward.

In the interest of expediting that task for TMH readers, our series, Anatomy of a Flagship Asset, introduces you to the most promising projects and products creating value in the Canadian stock market.

Next up, HPQ Silicon (HPQ), a technology company developing silicon, fumed silica and hydrogen production processes to expedite global net-zero emissions by 2050.

Green engineering with clear, value-added applications

HPQ is well on its way to becoming a leading silicon producer with an ESG-centric approach offering tangible advantages compared to legacy players.

Silicon

Silicon is a semi-conductor material that, like all other energy metals, does not exist in its pure state and is incredibly costly to extract. The E.U. considers silicon a critical raw material for its wide-ranging role in modern technologies behind industrial and consumer products.

Silicon demand is estimated to reach 3.8 million tonnes (MT) or US$20 billion by 2025 (CRU Group), with growth primarily driven by demand for chemical-grade silicon (99.5 per cent Si). The silicones product end market is growing at a 10.7-per-cent CAGR and expected to reach US$23 billion by 2025 (Markets and Markets).

Since 1899, the commercial extraction of silicon from quartz has relied on an expensive and energy intensive carbothermic process, meaning the industry is in dire need of disruptive technologies. HPQ Silicon considers itself up to this task.

The conventional carbothermic process produces 98 to 99.5 per cent silicon under the following constraints:

- Scalable by minimum increments of 30,000 tonnes/y

- Minimum investment over US$200 million

- Higher purity silicon production (2N-4N) limited to 40 per cent of plant output

- Required additional purification steps to reach battery grade (at least 3N)

- 6 tonnes of feedstock required to produce 1 tonne Si

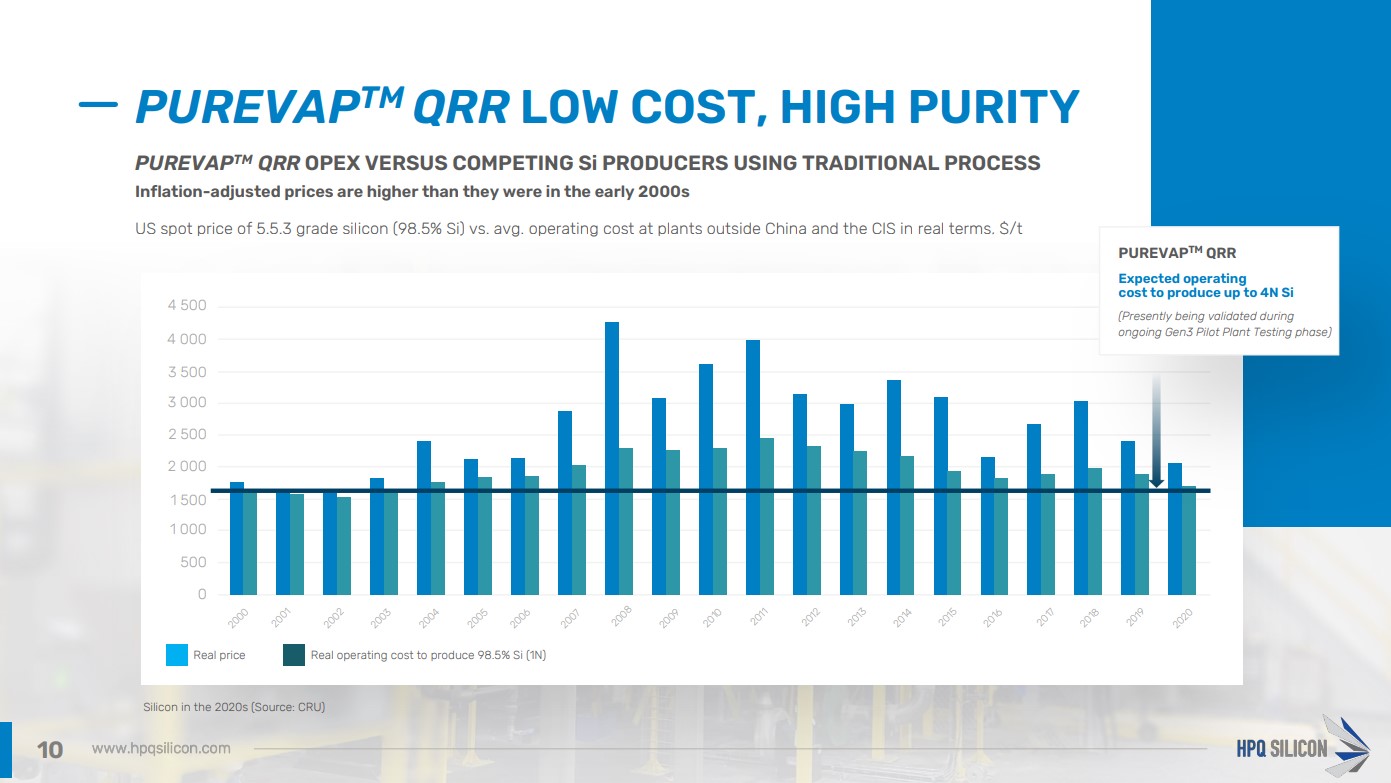

- An average of over US$2,000/tonne to produce 98 per cent metallurgical grade silicon

To inject some much-needed innovation into the industry, HPQ and technology partner, PyroGenesis, are developing the PUREVAP Quartz Reduction Reactor (QRR), a new low capex, opex and carbon footprint process to make up to 4N+ silicon in one step.

The PUREVAPTM QRR’s production of 99.5-99.99 per cent silicon offers considerable improvements compared to the legacy method:

- Scalable by minimum increments of 2,500 tonnes/y

- Minimum investment 85-90 per cent less than a conventional plant

- 4.5 tonnes of feedstock to produce 1 tonne Si

- Expected 3N to 4N Si production for less than US$2,000/tonne

- 3N to 4N+ Si production in one step, allowing HPQ to make material for battery applications for less than its competitors

3N to 4N+ silicon opens up many high-value product lines for HPQ. These include:

- Auto and EV manufacturers, who employ metallurgical grade silicon (98.5 per cent Si) to make vehicles lighter and stronger

- Its usage as feedstock to make micron-size silicon powders for Li-ion battery applications and silicon nitride, as well as nano silicon powder and nanowires for next-generation Li-ion battery applications

- Polysilicon for solar and electronics, an end market growing at a 20-per-cent CAGR expected to surpass US$200 billion by 2026 (Markets and Markets)

2N silicon is also a key feedstock needed for modern technology and to advance the clean energy revolution. Anticipated 2N demand is estimated to generate a 1 MT deficit over the next decade.

New plants will be needed to meet the aforementioned silicon demand, which HPQ is well advanced on, with crews set to break ground on its PUREVAP QRR plant in 2024. Commercial validation of the technology began in Q2 2022, with initial silicon production successfully completed in December 2022.

HPQ Nano Silicon Powders Division

HPQ is working to become the first producer of nano silicon powders made from high-purity silicon chunks, as well as the first North American producer of micron-size high-purity silicon powders, to advance the performance and capacity of Li-ion batteries and other clean tech applications.

Silicon nano materials represent an addressable market estimated to grow to 1,000 tonnes worth US$139 million by 2028, while the market for micron-size powders is projected to reach 200,000 tonnes worth US$2.6 billion by 2030.

The powders’ use-case reveals attractive economics. Graphite is the largest mineral in an EV battery by percentage, with demand exceeding supply for the first time in 2022, and the deficit projected to grow to 8 million tonnes by 2040. Replacing only 5 -10 per cent of graphite in battery anodes with micron-size Si or SiOx powders could potentially address the graphite deficit, improve battery performance, and generate long-term sustainable revenue for the company.

HPQ has already received a firm order (on an “if as” and “when” basis) for Si nanopowders from a major car manufacturer, on top of 7 NDAs with EV manufacturers, battery makers and other high-value materials companies, most of which indicate a strong preference for micron-size material.

HPQ will be progressing toward the creation of its PUREVAP Nanosilicon Reactor (NSiR) while manufacturing high-purity micron-size silicon material as a supportive revenue source.

Fumed silica

HPQ’s Silica Polvere Division focuses on green, low-cost production of fumed silica, a value-added white microscopic powder with a high surface area and low bulk density used in personal care, pharmaceuticals, agriculture (food & feed), adhesives, sealants, construction, batteries and automotives.

The company’s plasma-based process transforms quartz into fumed silica with no hydrogen chloride gas or hazardous chemicals and offers an 86-per-cent reduction in energy and carbon footprint compared to existing technology.

The required 15,000 kWh/MT, versus 110,000 kWh/MT traditionally, makes

capex a small fraction of that required for a legacy plant, opening the company up to a fumed silica market estimated at 424,000 tonnes worth US$2.2 billion in 2022.

In 2021, HPQ signed an agreement with PyroGenesis to develop a new Fumed Silica Reactor and commercialize the materials produced by the process. The agreement includes the $2 million construction and subsequent operation of a 50 tonne per year commercial pilot plant, with 33 per cent of the cost covered by the Federal Government and 30 per cent covered by the Government of Quebec.

Hydrogen

Alongside Novacium SAS, HPQ is developing a compact autonomous process for on-demand hydrogen production via hydrolysis of silicon and other materials.

The partners intend to build a lab-scale prototype for proof of concept by 2024, followed by a commercial validation prototype by 2025, and technical, economic, and operational scaling feasibility studies in 2026.

Future catalysts

HPQ’s immediate next steps in its technological development include improving silicon production yield and final purity to appeal to battery manufacturers and other high-value industries.

Its next test seeks to produce battery-grade silicon in one step, followed by the beginning of technical, economic and operational scaling feasibility studies for the PUREVAP QRR later this year.

As previously mentioned, the company will break ground on its PUREVAP QRR commercial plant in 2024, with an estimated start of commercial production by 2026. It expects to use the initial 2,500 tonnes per year of high-purity silicon produced by the reactor as feedstock for a battery material production line.

Following the onboarding of Novacium in Q3 2022 for R&D assistance and collaboration, HPQ is positioned to enhance its efforts in hydrogen and silicon powder manufacturing, as well as future-oriented innovations.

HPQ’s timeline for fumed silica development can be viewed on slide 20 of its most recent investor presentation.

The company’s future plans regarding silicon powders are laid out in slide 15 of its most recent investor presentation. To facilitate an early move toward production, HPQ and Novacium plan to build an initial 200 TPY production facility for micron-size silicon powders by 2024.

Potential investors should analyze these ambitious plans with a realistic outlook of the multi-year testing success required to make them a reality. That said, given Investissement Québec’s 9.6-per-cent ownership stake in HPQ, the company’s strong technology partners, and the broad addressable markets overdue for innovation, its chances of satisfactory long-term returns merit the full breadth of your due diligence process.

HPQ Silicon (HPQ) has gained over 144 per cent over the past 5 years, despite shedding nearly 50 per cent over the past year.

The material provided in this article is for information only and should not be treated as investment advice. For full disclaimer information, please click here.