The TSX, TSXV, CSE and NEO exchanges list over 4,000 companies, a daunting number for any investor to sort through.

Parsing prospective opportunities from also-rans begins with narrowing down your investable universe, leaving only companies whose value propositions mark a clear path forward.

In the interest of expediting that task for TMH readers, our new series, Anatomy of a Flagship Asset, introduces you to the most promising projects and products making waves in the Canadian stock market.

On a mission to maximize sustainability

Exro Technologies (EXRO) is a North American company dedicated to increasing energy efficiency in electric vehicles (EVs) and energy storage systems on the road to a cleaner, more sustainable future. It offers two main solutions toward this end.

Coil Driver

The company’s Coil Driver is an adaptive traction inverter for EV motors that uses patented coil switching technology to switch between two modes, series mode for high torque at low speeds and parallel mode for high power at high speeds.

Motor coils are the means by which current flows to an electric motor, with standard EV inverters facing a tradeoff between low-speed and high-speed operation.

With the benefit of smarter energy consumption, next-generation control algorithms, and bi-directional power flow enabling it to function as an EV charger, eliminating the need for a separate system, the AVL-validated technology offers significant cost and weight reductions to electrical powertrain manufacturers.

Cell Driver

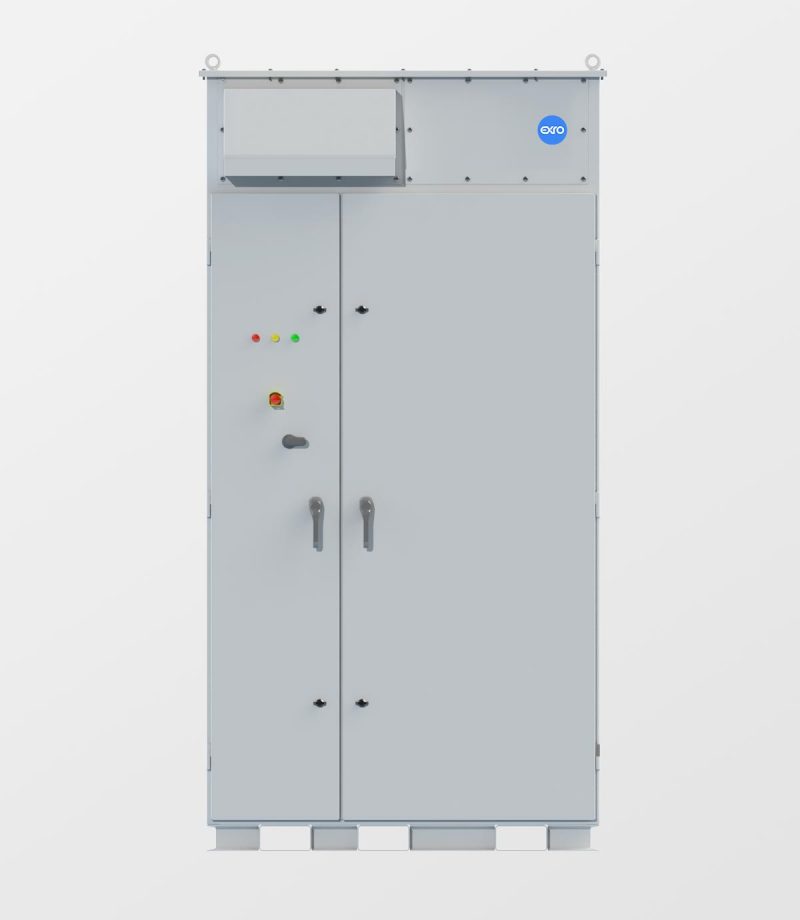

Exro’s Cell Driver is an integrated energy storage system that uses the company’s Battery Control System (BCS) to actively manage battery cells based on state of health and state of charge. The BCS is able to balance between charging and discharging, enhancing energy usage, safety, and overall lifespan, while isolating faults without interrupting power delivery.

The solution is especially relevant for used EV batteries – whose lifespan it is able to almost double from the conventional 8-12 years – thus reducing emissions and the need for raw earth materials.

Other benefits include grid-connected and island-based operation, load shifting, peak power shaving and power frequency regulation.

Equipped with a modular plug-in design, the Cell Driver reduces the total cost of EV or energy storage ownership by affording batteries a second life.

And if that weren’t enough, Exro also provides end-to-end engineering services for electrified power systems, with partners to date including the likes of Linamar, VMC, evTS and SEA Electric, as well as a growing number of global automotive and equipment suppliers under NDAs.

Future catalysts

The main driver of Exro’s shareholder value creation is EV adoption growth, with the market expected to almost double over the next five years.

According to Statista, EV revenue is on track to reach US$457.6 billion in 2023, with growth projected at a CAGR of 17.02 per cent until 2027, resulting in a total market volume of US$858 billion across 16.21 million vehicle sales.

With China, Europe and the U.S. representing 95 per cent of global EV sales, potential investors should favour Exro’s expansion in these markets as government subsidies and affordable models attract more consumers and with them, a collective expectation for reliable, long-lasting performance.

Statista sees the global battery market – which will continue to be dominated by the lithium-ion segment – growing more than 4x from US$112 billion in 2021 to over US$420 billion by 2030, fortifying Exro with industry diversification as EV sales normalize as they displace internal combustion vehicles.

Exro Technologies (EXRO) is up by over 90 per cent YoY, which is approximately equivalent to its entire return since inception, offering an intriguing entry point should your due diligence process justify the company’s place in your portfolio.