- Canada Nickel Company (CNC) is advancing high-quality, high-potential nickel-cobalt projects for the electric vehicle and stainless steel markets

- Based on measured and indicated resources, the company’s Crawford Project in Ontario houses the fifth-largest nickel-sulphide resource globally at 3.5 Mt of contained nickel

- Canada Nickel has identified 11 nearby targets of Crawford’s size and host mineralization, which could potentially result in a district-scale nickel camp

- Canada Nickel Company (CNC) is up by over 87 per cent since its inception, which is reflective of the company’s considerable upside potential as it works toward economical mineral extraction

The TSX, TSXV, CSE and NEO exchanges list over 4,000 companies, a daunting number for any investor to sort through.

Parsing prospective opportunities from also-rans begins with narrowing down your investable universe, leaving only companies whose value propositions mark a clear path forward.

In the interest of expediting that task for TMH readers, our new series, Anatomy of a Flagship Asset, seeks to introduce you to the most promising projects and products making waves in the Canadian stock market.

Ushering Timmins nickel onto the global stage

Canada Nickel Company (CNC) is advancing high-quality, high-potential nickel-cobalt projects for the electric vehicle and stainless steel markets.

The company has consolidated 42 km2 of a new nickel district in Ontario’s well-established Timmins Mining Camp, which is quickly gaining ground in Sudbury as Canada’s primary nickel-producing region. The district is prospective for large-scale, lower-grade, open-pit nickel-sulphide projects with potential zero-carbon production led by Canada Nickel’s flagship Crawford Nickel-Sulphide Project.

Crawford will produce two nickel concentrates, including a high-grade concentrate at 35 per cent nickel and an iron concentrate containing chrome.

The project’s most recent mineral resource estimate doubled the measured and indicated (M&I) resource to 1.4 billion tonnes at 0.24 per cent nickel, plus a further 670 million tonnes of inferred resources at 0.23 per cent nickel.

Based on M&I resources, Crawford houses the fifth-largest nickel-sulphide resource globally at 3.5 Mt of contained nickel. It also represents the largest nickel-sulphide discovery since the early 1970s.

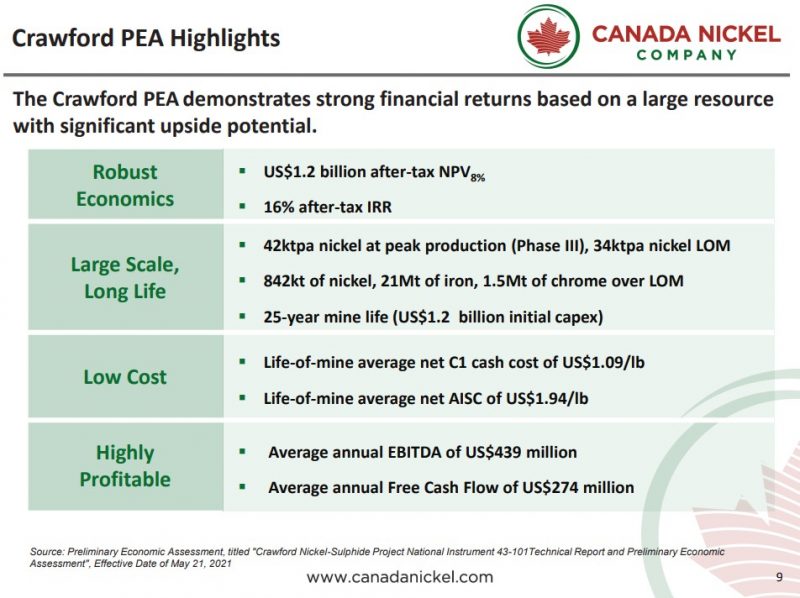

May 2021’s preliminary economic assessment (PEA) confirms robust economics, with Crawford expected to become one of the largest base metal mines in Canada while achieving 1st quartile net C1 cash cost and all-in sustaining costs.

The PEA follows a 17-per-cent rise in global nickel demand in 2021 (3-5X

other base metals), with management expecting the figure to double by 2030 to over 5 Mt. Assays for drill holes testing for further resource expansion at Crawford are pending.

The latest locked cycle test delivered 62 per cent total nickel recovery – 10 per cent better than the PEA – with improvements in cobalt and iron recovery, as well as iron grades. Each percentage point improvement in nickel recovery adds US$92 million to the NPV8% of the project.

Crawford will also be a site of environmental stewardship, as its lower-grade sulphide product will generate only 2.8 tonnes CO2/tonne of nickel produced, compared to 34 and 88 tonnes for acid and coal-based approaches prevalent in world-leading Chinese and Indonesian production. Canada Nickel is also evaluating carbon sequestration using Crawford’s tailings and waste rock.

Future catalysts

Crawford’s final feasibility study, expected in Q2 2023, is targeting a resource between 1.3 and 1.8 billion tonnes, which should offer plenty of positive sentiment and newfound investor interest. But the picture is far more prospective than that.

Canada Nickel has identified 11 nearby targets of Crawford’s size and host mineralization, such as the large-scale discovery at Reid, which is already delineating a mineralized footprint 90-per-cent of Crawford’s size, and the latest assays from the Deloro target, which includes 394 m of 0.26 per cent nickel.

This is in addition to the Texmont Mine, acquired in December 2022, whose historic resource estimate stands at 3.2 million tonnes grading 0.9 per cent nickel.

The company sees the potential to unlock a district-scale nickel camp as it works out the economics to bring Crawford’s resources to market.

Meanwhile, a lull in investor interest has cut CNC shares by over 50 per cent due to high inflation and ensuing risk-off sentiment, teeing up interested investors to engage in their due diligence processes and take advantage of excess pessimism.

With $22 million in cash as of January 3, 2023, and permitting at Crawford well underway – namely, the acceptance of the detailed project description and the signing of impact assessment agreements with the Taykwa Tagamou Nation – catalysts to monitor this year besides Crawford’s feasibility study include strategic investors, offtake agreements and systematic district exploration.

Canada Nickel Company (CNC) is up by over 87 per cent since its inception, which is reflective of the company’s considerable upside potential as it works toward economical mineral extraction.