- Anaergia (ANRG) announced its financial results for the three-month period ended March 31, 2022

- Revenue for the first quarter rose to $40.0 million from $37.6 million in Q1, 2020

- Gross profit for the first quarter decreased by 3 per cent from the same period in the prior year

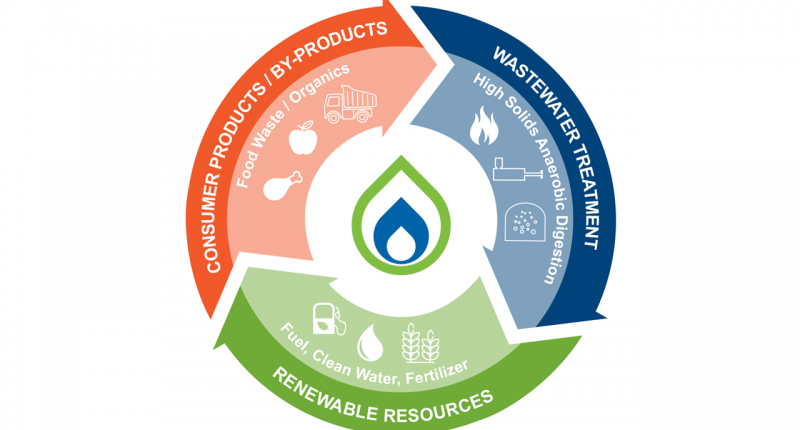

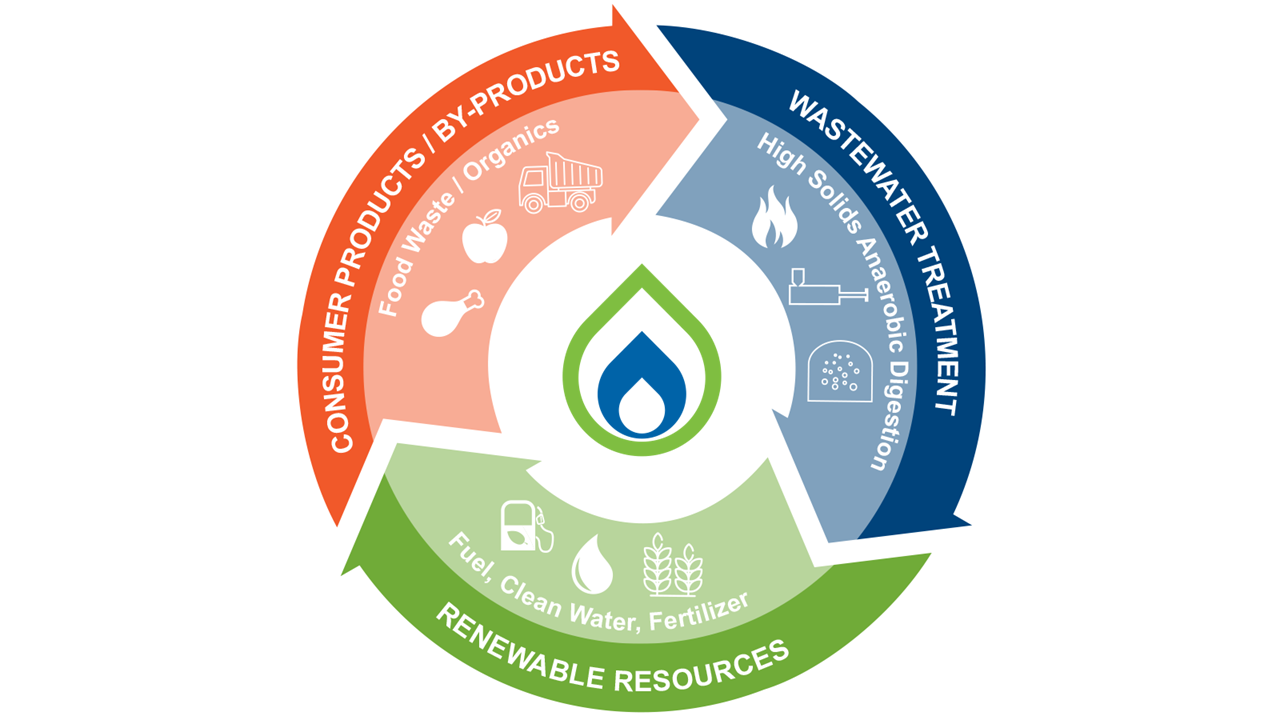

- Anaergia was created to eliminate a major source of greenhouse gases by turning organic waste into renewable natural gas (RNG), fertilizer and water

- Anaergia Inc. (ANRG) is down 2.06 per cent on the day, trading at C$6.18 per share at 2 pm ET

Anaergia (ANRG) announced its financial results for the three-month period ended March 31, 2022.

Anaergia’s first-quarter results show another increase in revenues.

Dr. Andrew Benedek, Chairman and CEO of Anaergia commented on the results.

”The market fundamentals we are seeing have improved globally. In management’s view, energy security will be a very significant industry driver for years to come, and this new reality is expected to have dramatic consequences for Anaergia and other international renewable energy supply companies. This is particularly true in Europe where we are seeing tight natural gas markets and the tail winds from the European Union’s resolve to achieve natural gas independence from Russia, which presents an historic opportunity for Anaergia. It is increasingly apparent that, because of these changes, our European build-own-operate (BOO) projects are poised to be more profitable than had been originally anticipated and the number of new opportunities for capital sales and investment is significantly higher than at the time of our IPO.”

As previously disclosed, fiscal 2022 revenues were expected to start slowly in the first quarter and then accelerate in each of the following quarters with particularly high revenues in the fourth quarter of 2022, primarily because the Renewable Natural Gas (RNG) being produced at the Rialto Bioenergy Facility (RBF) and stored until the final registration of the Renewable Identification Numbers (RIN) and California Low Carbon Fuel Standard (LCFS) is expected to begin generating revenue in the fourth quarter of 2022.

Q1 2022 financial highlights

- Revenue for the first quarter rose to $40.0 million from $37.6 million during the same period in 2020. The increase was driven primarily by more activity in Italy.

- Gross profit for the first quarter decreased by 3 per cent from the same period in the prior year

Anaergia was created to eliminate a major source of greenhouse gases by turning organic waste into renewable natural gas (RNG), fertilizer and water, using proprietary technologies.

Anaergia Inc. (ANRG) is down 2.06 per cent on the day, trading at C$6.18 per share at 2 pm ET.