As commodity prices continue to soar due to COVID-induced supply shortages, the Russia-Ukraine war and record inflation, metals producers are occupying an enviable position in the global investment landscape. One such firm is Eastern Platinum (TSX:ELR; JSE:EPS), a Vancouver-based outfit operating chrome and platinum group metals (PGM) assets in South Africa.

On May 20, 2022, it filed an updated NI 43-101 Technical Report on its flagship Crocodile River Mine (CRM), a PGM property located 70 km from Johannesburg, as it prepares to restart underground mining at the Zandfontein Section.

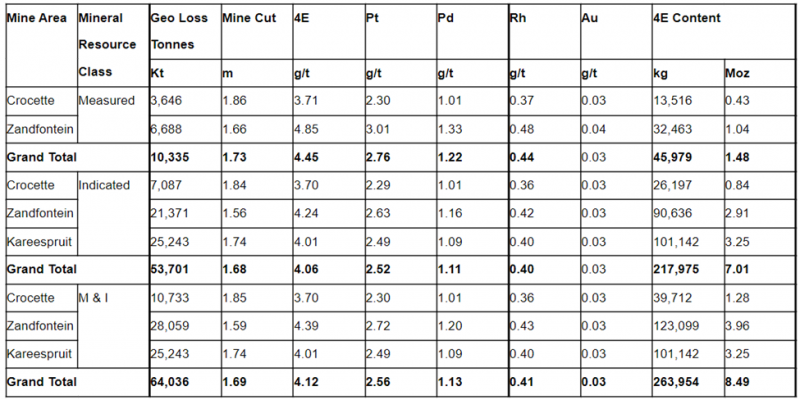

Besides Zandfontein, CRM also includes the Crocette and Kareespruit development sections. The mine’s measured and indicated resources as of January 1, 2022, are as follows:

CRM’s inferred mineral resources are laid out below:

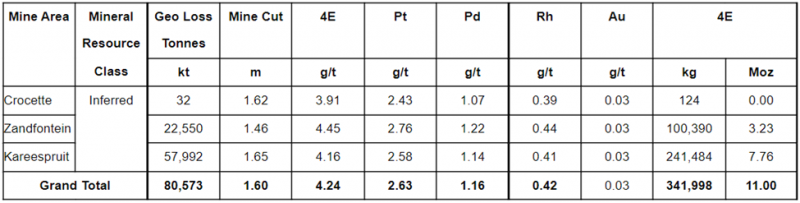

Eastern Platinum also recovers chrome as part of its Retreatment Project at the Zandfontein tailings storage facility (TSF). The TSF’s mineral resources as of January 1, 2022, are detailed in the following table:

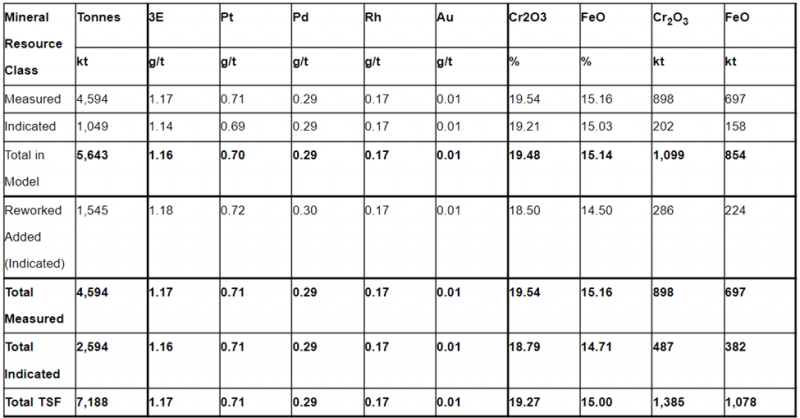

The mineral reserve estimate for the Zandfontein section of CRM underground mining as of January 1, 2022, is comprised of:

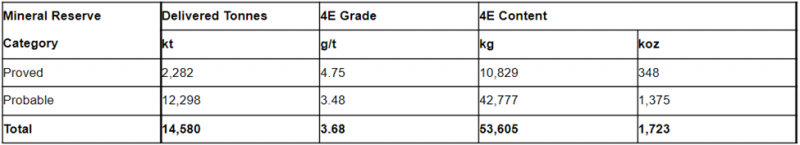

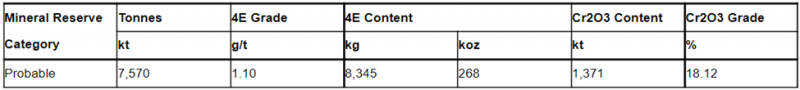

Finally, the mineral reserve estimate for the TSF re-mining operation as of January 1, 2022, is as follows:

Based on the updated resources and reserves, Eastern Platinum will restart underground mining with a focus on Zandfontein. It will employ a hybrid mining method with minimal off-reef development and has already planned a production ramp up to steady state volumes.

The restart project offers a net present value of US$188M excluding the TSF and US$202M including the TSF. Select parameters include:

- An 11.87 per cent discount rate

- An exchange rate of US$1 to ZAR$15.53

- A life of mine of 1.51M 4E oz of commercial production over 22 years

- Non-sustaining capital costs of US$21M with total all-in costs of US$1,537 per 4E oz

- A payback period of two years including the TSF

Equipped with these encouraging figures, Eastern Platinum will now focus on securing funding to restart underground mining later this year with palladium up 132 per cent over the past five years, chrome concentrate up over 52 per cent over the past year, and the price of platinum up a stable 12 per cent over the past five years.

From an investment perspective, the company’s Q1 2022 finances are well-positioned to take on capital and undertake the development effort:

Revenue was US$17.4M, up 4.3 per cent from US$16.7M in Q1 2021 due to an increase in PGM sales.

Mining operating income was US$3.4M, up 137.5 per cent from US$1.4M in Q1 2021, improving gross margins to 19.6 per cent from 8.6 per cent in Q1 2021.

Operating income was US$0.1M, up from a loss of US$1.7M in Q1 2021.

Net income attributable to shareholders was US$3M (US$0.02 EPS), up from a loss of US$0.9M (US$0.01 loss per share) in Q1 2021 attributable to foreign exchange gain due to appreciation of the South African rand relative to the U.S. dollar.

Working capital was US$17.2M, up from US$14.6M on December 31, 2021, while short-term cash was US$6.6M, up from US$6.1M on December 31, 2021.

Approximately 84 per cent of Q1 2022 revenue stemmed from the offtake agreement with Union Goal Offshore Solution Limited – a major trader of chrome ores and concentrates – related to chrome concentrate production from the Retreatment Project. The remainder was from PGM concentrate sales to Impala Platinum Limited.

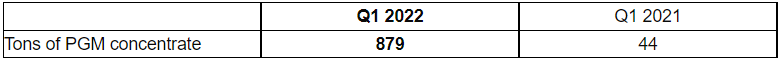

PGM Circuit D and PGM Main Circuit B (which was commissioned in October 2021) continue to produce PGM concentrate and drive revenue growth and gross margin improvement. PGM production for the quarter reflects the company’s continued optimization and refurbishment efforts:

Toward the end of Q1 2022, Eastern Platinum also successfully closed the sale of the Maroelabult Project with Eland Platinum for US$1.3M.

“The Q1 financial results have shown the company is on the right path to continue its revenue growth and profitability improvements from the Retreatment Project and capacity increases from the PGM circuits,” stated Diana Hu, Eastern Platinum’s President and CEO.

Potential investors can learn more about the company by visiting eastplats.com.

FULL DISCLOSURE: This is a paid article produced by Stockhouse Publishing.