- American CuMo (MLY) has closed its oversold private placement for proceeds of C$750,000

- This includes subscriptions from insiders for 350,000 units

- The company will use the proceeds for general corporate purposes and to make the final EU$235,000 payment under the Bleiberg Property deal announced in March

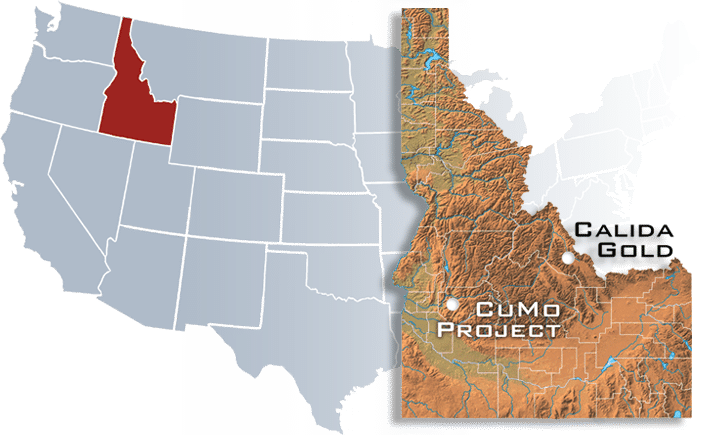

- American CuMo Mining is focused on advancing the Idaho-based CuMo and Calida Gold projects

- American CuMo (MLY) is unchanged trading at $0.04 per share

American CuMo (MLY) has closed its oversold private placement for proceeds of C$750,000.

The company received subscriptions for 15,000,000 units, including 350,000 from insiders.

Each unit is comprised of one common share and one transferable common share purchase warrant.

Each warrant is exercisable to purchase one common share priced at C$0.075 for 60 months from the closing of the offering, subject to acceleration with 20 days’ notice.

The company will use the proceeds for general corporate purposes and to make the final EU$235,000 payment under the Bleiberg Property deal announced in March.

American CuMo Mining is focused on advancing the Idaho-based CuMo and Calida Gold projects.

American CuMo (MLY) is unchanged trading at $0.04 per share as of 10:03 am EST.