- Altiplano Metals (APN) has reported record results for Q2 2022 from the Farellon mine located near La Serena, Chile

- During Q2, the company extracted a total of 10,742 tonnes of mineralized Cu-Au material at Farellon

- Sales of copper generated approximately US$967,685 in revenue for Q2

- Altiplano has generated over US$9.86 million from the recovery and sale (after processing costs) of 4.47 million pounds of copper

- Altiplano Metals (APN) is a gold, silver, and copper company focused on the Americas

- Altiplano Metals Inc. (APN) opened trading at C$0.225

Altiplano Metals (APN) has reported record results for Q2 2022 from the Farellon Copper-Gold-Iron (Cu-Au-Fe) mine located near La Serena, Chile.

During Q2, 2022, the company extracted a total 10,742 tonnes of mineralized Cu-Au material at Farellon and processed 7,488 tonnes at an average copper grade of approximately 1.96 per cent.

Sales of copper generated approximately US$967,685 in revenue, representing the highest revenue total to date from Q1 2018, beating the previous record posted in Q1 2022.

At the end of June 2022, the company had 520 tonnes in stockpiles at the Farellon site and a total of 2,600 tonnes stockpiled at the El Peñón mill site. This material will be processed for sale and the revenue will be realized in the next coming months.

Total tonnes extracted and processed in Q2 increased by 9 per cent and 11 per cent respectively from the previous quarter; however overall grade, at 1.96 per cent, represents a 5 per cent decrease from the fourth quarter. The decrease in grade is attributed to minor dilution observed with bench mining oversize material from the ceilings of previous working levels.

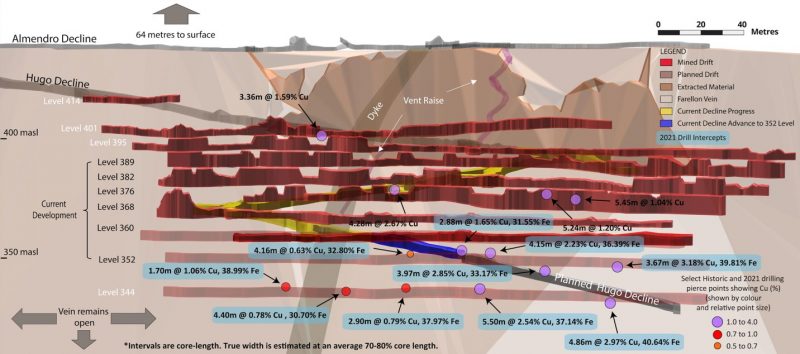

In addition, the waste removal in Q2 increased by 45 per cent to 2,725 tonnes over Q1 as a result of the Hugo Decline expansion to the 352 m level.

President and CEO Alastair McIntyre commented on the company’s results.

“We are very pleased the results generated at the Farellon operation. Improved efficiencies and excellent grades combined with great copper prices has resulted in two very significant back-to-back quarters. The first half of 2022 has produced nearly US$2 million in revenue, after processing costs, from the sale of over 600,000 pounds of copper. These results are very significant milestones for the company and set us up well as we move to transition our processing at El Peñón.”

| Period | USD Revenue | Cu Pounds Sold |

| Q1 2021 | $540,713 | 257,522 |

| Q2 2021 | $599,711 | 220,660 |

| Q3 2021 | $561,345 | 221,518 |

| Q4 2021 | $779,054 | 267,927 |

| Q1 2022 | $908,419 | 295,199 |

| Q2 2022 | $967,685 | 310,062 |

Altiplano has generated over US$9.86 million from the recovery and sale (after processing costs) of 4.47 million pounds of copper with an average grade of 1.78 per cent Cu (2018 Q1-2022 Q2).

Cash flow has been re-invested into equipment, underground drilling, expanding underground development at Farellon, enhancing ventilation to increase productivity and capacity, new underground development and exploration at Maria Luisa, and the commissioning of the El Peñón fit-for-purpose mill and flotation plant located 15 km from the Farellon site.

Altiplano Metals (APN) is a gold, silver, and copper company focused on the Americas.

Altiplano Metals Inc. (APN) opened trading at C$0.225.