- Alphamin Resources Corp. reports record quarterly tin production of 3,180 tonnes

- Q2 EBITDA3 of US$6M

- Interim dividend for FY2022 of C$0.03 per share declared on July 5, 2022

- Alphamin’s consolidated net cash position increased by US$8.3 million during Q2 2022 to US$138.1 million

- The company says it expects “contained tin production and sales of ∼ 3,000 tonnes for the quarter ending Sep. 2022”

- Alphamin produces ∼ four per cent of the world’s mined tin1 from its high-grade operation in the Democratic Republic of Congo

- Alphamin Resources Corp. (AFM) is up 1.35 per cent and is trading at C$0.75 as of 11:26 am EDT

Alphamin Resources Corp. (AFM) has provided an operational update for the quarter ended June 2022.

Highlights:

Operational and Financial Performance – Q2 2022

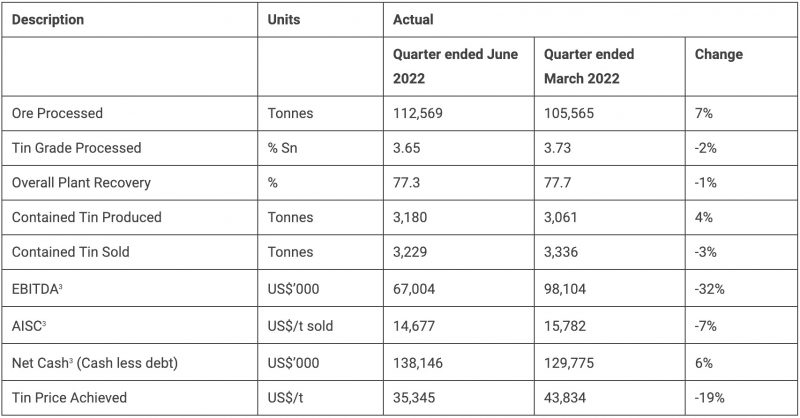

Contained tin production of 3,180 tonnes represents a quarterly record – four per cent above the previous quarter.

Year-to-date contained tin production of 6,241 tonnes exceeded the run-rate to achieve market guidance of 12,000 tonnes for the year ending December 2022.

The company says it expects “contained tin production and sales of approximately 3,000 tonnes for the quarter ending September 2022.”

AISC per tonne of tin sold decreased by seven per cent to US$14,677 following a four per cent increase in production and the impact of lower tin prices on off-mine costs related to product marketing fees, royalties, export duties, and smelter payables.

EBITDA for Q2 2022 amounted to US$67M (Q1: US$98M) at an average achieved tin price of US$35,345/t (Q1: US$43,834/t).

In addition to a higher tin price, the previous quarter’s sales volumes included a catch-up from delayed sales during Q4 2021.

The Alphamin consolidated net cash position increased by US$8.3 million during Q2 2022 to US$138.1 million. This increase is after a FY2021 corporate tax payment of US$43.5 million to the DRC government in April 2022.

Alphamin Resources is a low-cost tin concentrate producer from its high-grade deposit at Mpama North in the Democratic Republic of Congo (DRC). This is on its mining license and it has an additional five exploration licenses covering a total of 1,270 square kilometres in the North Kivu Province of the DRC.

Alphamin Resources Corp. (AFM) is up 1.35 per cent and is trading at C$0.75 as of 11:26 am EDT.