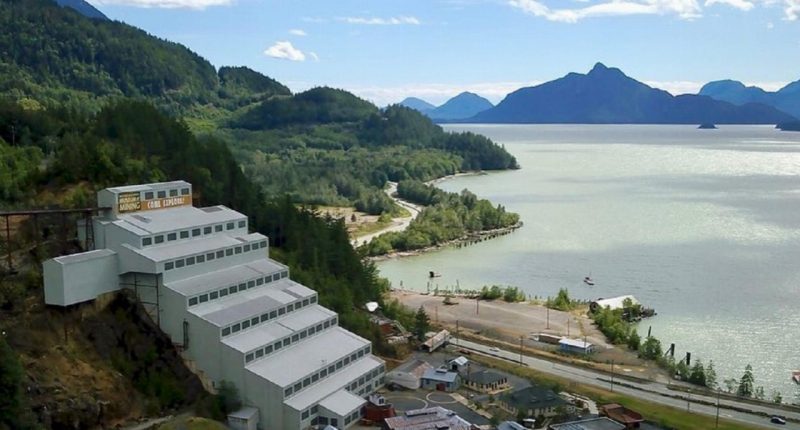

British Columbia is seeing an expansion in mining, with eight new mines collecting roughly $6.6 billion in funding.

Additionally, last month the Association for Mineral Exploration (AME) annual conference gathered industry experts from across the globe. At this event the Premier of British Columbia, David Eby, stated that the province had seen record-breaking exploration overheads of $740 million for 2022.

Investments indicate province’s potential

Some of the major resources the province hosts are gold, silver, and copper. In fact, British Columbia is Canada’s largest producer of copper, which has become a hot commodity with the rise of electrification movements.

Additionally, Kendra Johnston, President and CEO of the AME, commented,

“Mineral explorers are searching for critical minerals on more than 230 projects located in all regions of B.C., including 178 copper exploration projects.”

The province has a history behind its gold rush era, and it looks like prospecting excitement has come back to life with the demand for copper and other clean energy minerals.

Also, project opportunities in B.C. appear to be abundant and it’s receiving more investor and government support. These projects offer more support for their surrounding communities as well.

Local economies to benefit as well

According to the Mining Association of British Columbia, a single mining operation can create an abundance of job opportunities across the province alone. Certain supporting industries such as engineering, fuel, and fleet tires are all sourced to help drive a mine.

With exploration work in the province on the rise, it’s worth keeping an eye on small-cap companies. Businesses like Artemis Gold (ARTG) and Armac Resources (AHR) are currently developing precious and base metals projects that show investment potential.

As a take away, gold and silver commodities have a long record of being reliable investments, and copper mine establishment timelines will subsequently drive up its demand. Canadian investors should look close to home for ground-up mineral investment opportunities.