- Alianza Minerals (ANZ) has reported additional results from the 2021 drilling campaign at the Haldane high-grade silver property

- Drilling has focused on the West Fault Complex target

- Alianza Minerals is a Canada-based exploration company

- Some of its properties include Yanac Project, Horsethief, Bellview, Twin Canyon, BP Project, Haldane, and KRL

- Alianza Minerals Ltd. (ANZ) opened trading at C$0.095 per share

Alianza Minerals (ANZ) has reported additional results from the 2021 drilling campaign at the Haldane high-grade silver property.

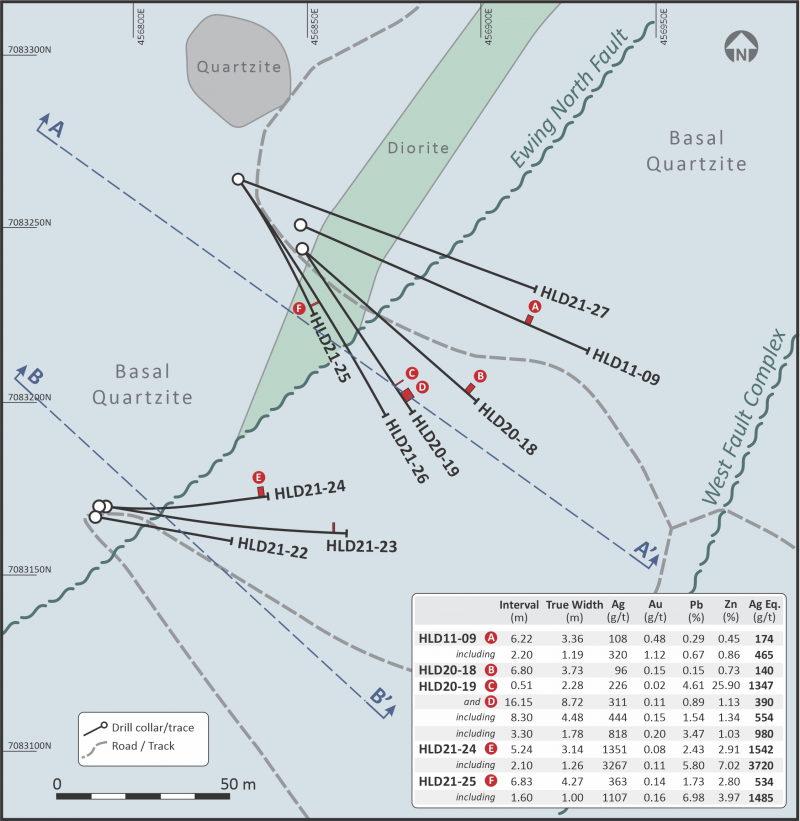

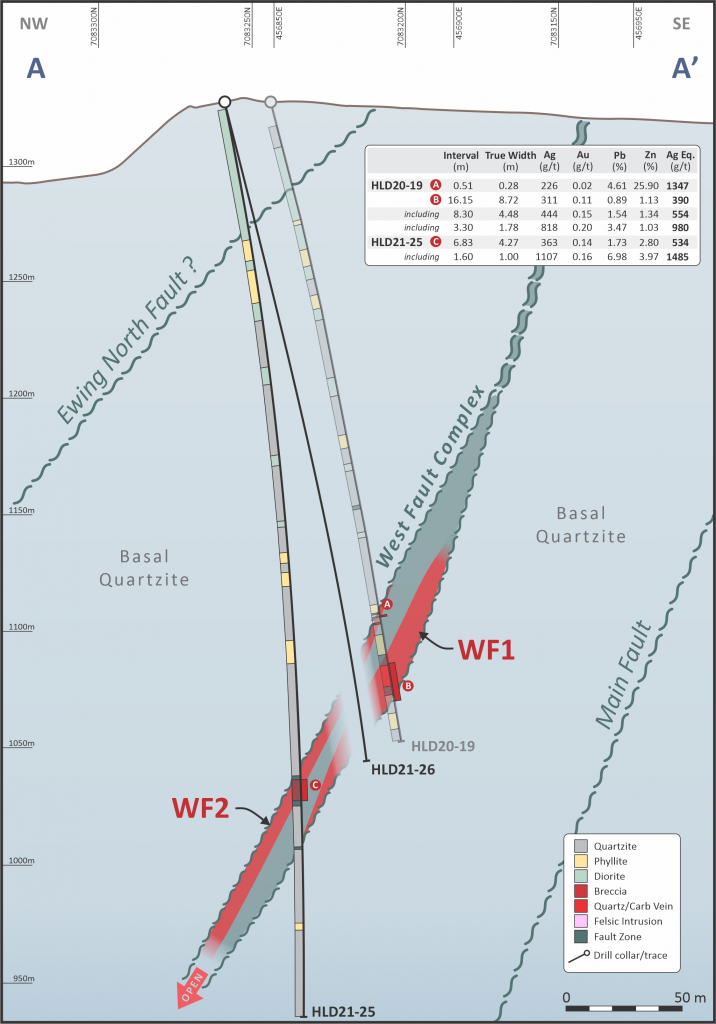

Drilling has focused on the West Fault Complex target where a strong vein-fault system with high-grade silver mineralization is being defined. Following up on the initial success in hole HLD20-19, HLD21-25 has further extended the West Fault mineralization by 62 metres down dip with an intersection averaging 1,107 g/t silver, 6.98% lead and 3.97% zinc (1,485 g/t silver-equivalent(2)) over 1.60 metres (estimated true width of 1.00 metres). The 8,579 hectare Haldane Property is located in the western portion of the Keno Hill Silver District, 25 kilometres west of Keno City, YT.

Exploration at Haldane is targeting extensions of historical high-grade silver production on the property as well as recently defined targets, such as the West Fault, in new areas of the property.

Jason Weber, P.Geo, President and CEO of Alianza sat down with Caroline Egan to discuss the program results.

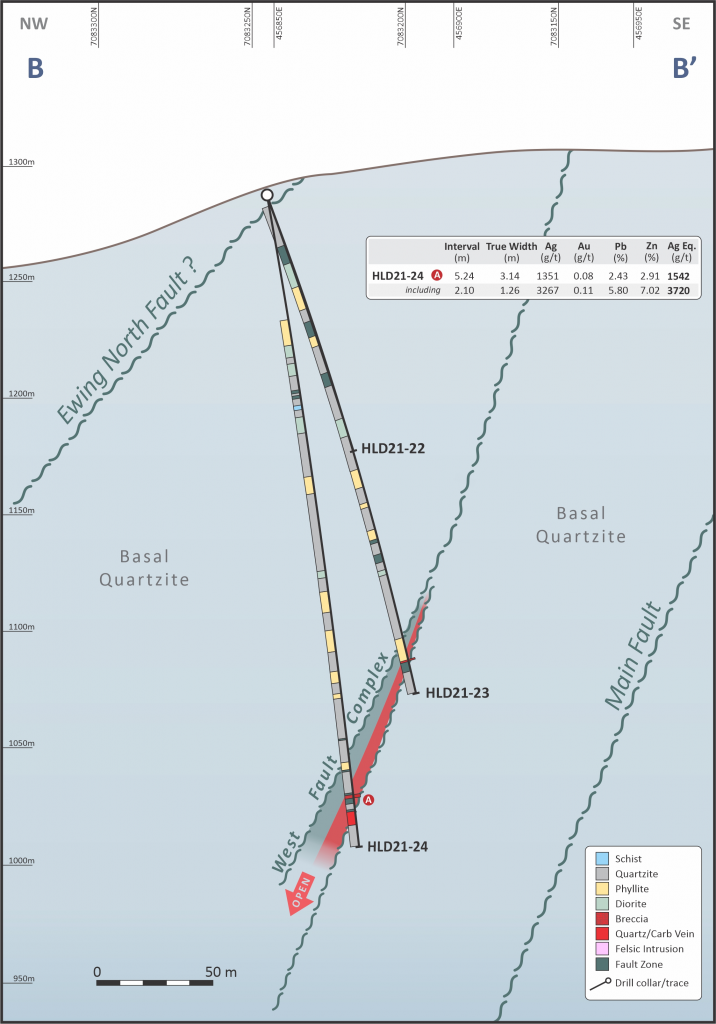

“We continue to expand the West Fault Complex mineralization at Haldane, with our third high-grade silver intersection. We have now extended the known mineralization 62 metres down dip in this hole and in our previously released HLD21-24, we have extended mineralization 75 metres down dip and approximately 50 metres along strike of HLD20-19. The additional holes at West Fault Complex are showing that it is a large structure with excellent potential for additional high grade silver mineralization.”

Table 1 – West Fault Target Drill Intercepts

| Hole | From (m) | To (m) | Interval(m) | Est True Width (m)(1) | Silver(g/t) | Gold(g/t) | Lead(%) | Zinc(%) | Silver Eq.(2)(g/t) |

| HLD21-23 | 211.1 | 211.4 | 0.3(3) | 0.18 | 145 | 0.53 | 0.30 | 19.3 | 925.6 |

| HLD21-24(4) | 265.86 | 271.1 | 5.24(3) | 3.14 | 1351 | 0.08 | 2.43 | 2.91 | 1542 |

| Including | 269.0 | 271.1 | 2.10 | 1.26 | 3267 | 0.11 | 5.80 | 7.02 | 3720 |

| HLD21-25 | 293.44 | 300.27 | 6.83 | 4.27 | 363.4 | 0.14 | 1.73 | 2.80 | 534.2 |

| Including | 295.80 | 297.40 | 1.60 | 1.00 | 1107 | 0.16 | 6.98 | 3.97 | 1485 |

- True width of the vein and breccia mineralization is estimated to be 50-70% of the core length intersection with the exception of HLD21-25 where precise measurements of vein contact angles yield 62.5% of the core length intersection. A value of 60% is used for the purposes of reporting HLD21-23, 24 and 62.5% for HLD21-25.

- Silver-equivalent values are calculated assuming 100% recovery using the formula: ((20 * silver (g/t) / 31.1035) + (1650 * gold (g/t) / 31.1035) + (0.90 * 2204 * lead %/100) + (1.10 * 2204 * zinc %/100)) *(31.1035 / 20). Metal price assumptions are US$20/oz silver, US$1650/oz gold, US$0.90/lb lead and US$1.10/lb zinc.

- Core recovery is estimated at 70-75% for HLD21-24 and 25, with the exception of a 0.80-metre section of HLD21-24 where recovery was zero. A value of zero was assigned to silver, gold, lead and zinc for the section of zero core recovery for the purposes of composite interval calculations. Core recovery is estimated at 46% for HLD21-23.

- Previously released July 12, 2021.

Alianza Minerals is a Canada-based exploration company engaged in the acquisition and exploration of mineral properties. Some of its properties include Yanac Project, Horsethief, Bellview, Twin Canyon, BP Project, Haldane, and KRL. Its geographical segments are United States, Canada, and Peru.

Alianza Minerals Ltd. (ANZ) opened trading at C$0.095 per share.