The elements of a screaming buy of a mining stock are no surprise and hard to find.

A focus on metals and minerals with well-established markets and use-cases sits at the top of the list, followed by a history of profitability, free cash flow, growing production and high return on equity, vetting management’s ability to optimize operations while prioritizing shareholders.

Then we have long-term mineral resources in strategic jurisdictions, positioning investors for outsized returns over full economic cycles, complemented by sound allocations of excess cash with an eye on structuring the company to capitalize on the evolving mining landscape.

If this portrait sounds too good to be true, it’s because it more or less is. The odds of finding a viable mineral deposit are low and even these often don’t become mines for various reasons. Of those that do, most mining operations require extreme technical, logistical and leadership expertise to be run safely and efficiently. This is why choosing worthwhile mining stocks can feel like searching for buried treasure, much like a drilling crew hard at work out in the wilderness.

Silvercorp Metals (TSX:SVM / NYSE-A:SVM), a Vancouver-based company that is China’s largest primary silver producer, is undoubtedly one of those diamond-in-the-rough opportunities deserving of greater market recognition.

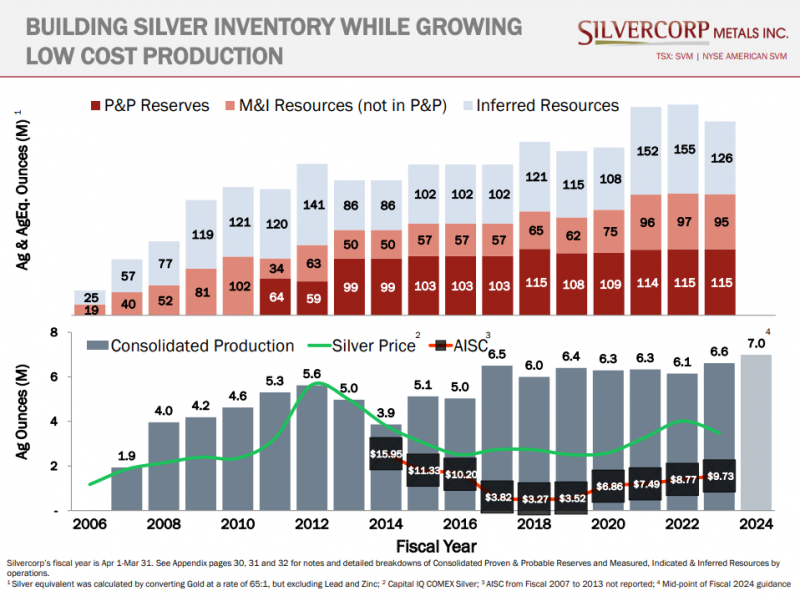

The underground mining specialist’s flagship operation in the Ying District has produced over 80 Moz of silver and 1 billion pounds of lead and zinc since 2006, with more than 15 years of mine life remaining after 17 years of production. Its other producing operation, the GC Mine, has produced over 5 Moz of silver and 190 million lbs of lead and zinc since 2014, with current reserves supporting mining through 2034.

This astounding output has led the company to generate US$1.6 billion in revenue at an average gross margin of approximately 50 per cent over the past decade – plus 100-per-cent internally financed growth since 2010. Shareholders who stood by their conviction were rewarded with an unwavering focus on profitability, with current cash holdings in excess of $200 million.

This consistent value creation is enabled by disciplined operations that include AISC silver costs of US$9.73 in fiscal 2023, which compare favorably to the metal’s current price of just under US$24 per ounce, and the growth in already considerable mineral resources and reserves.

FY 2023 featured production of 6.6 Moz of silver, 4,400 ounces of gold, 68.1 million lbs of lead, and 23.5 million lbs of zinc, representing increases of 8%, 29%, and 6%, respectively, in silver, gold, and lead.

Silvercorp’s long-term operational performance is currently being undervalued in the market, with an enterprise value/EBITDA (TTM)* around 5.9x versus the peer average of 19.1x, and a price/operating cash flow (TTM)* around 7.3x versus a peer average of 101.4x, representing an attractive entry point for the mining sleeve of your portfolio. And, as if that weren’t enough, the company recently fortified its business through exposure to copper, adding some diversification to future revenue streams.

* – Source: Capital IQ (May 19, 2023)

A disciplined acquisition to unlock diversifying growth

Last month, Silvercorp signed a non-binding term sheet to acquire Celsius Resources (ASX/AIM:CLA) – which holds the advanced-stage Maalinao-Caigutan-Biyog (MCB) copper-gold project in the Philippines – for AUD$56 million.

A JORC-compliant mineral resource estimate (December 2022) for MCB details measured and indicated resources of 1.36 million tonnes of copper and 1.146 Moz gold, as well as inferred resources of 0.218 million tonnes of copper and 0.149 Moz gold.

A 2021 scoping study outlined a development plan for an underground mining operation with estimated annual production of 22,000 tonnes of copper and 27,000 ounces of gold for the first decade of a 25-year mine life, and the project generates a post-tax NPV (8%) of US$464 million, an IRR of 31%, and a payback period of 2.7 years.

Now in the final stages of permitting, MCB’s estimated resources are also likely to be expanded in the future, with numerous high-priority brownfield and greenfield exploration targets within its 27.2 km2 land package.

Silvercorp has taken a 15-per-cent stake in Celsius to provide interim funding for MCB prior to the transaction closing, and plans to spin out Celsius’ Sagay (Philippines) and Opuwo (Namibia) projects to Celsius shareholders.

The acquisition would add copper, a key green energy driver, to Silvercorp’s stable, further diversifying its precious and base metal activities, while positioning it for self-funded, near-term development at MCB and exploration in the Pacific Rim Metallogenic Belt, a globally significant porphyry copper-gold belt, aided by Celsius’ well-established team and strong local relationships.

The transaction – subject to a definitive agreement, as well as customary Celsius shareholder approvals – would also strengthen the company’s reputation as an intelligent capital allocator, as evidenced by its 28.2% holding in New Pacific Metals (201 Moz silver resource), which is up over 2.4x since 2017 to over US$95 million.

A mining stock with tailwinds galore

Silvercorp is planning over 270,000 m of drilling in FY 2024 to pursue extensions of known mineralization and newly discovered gold veins. The company will also be advancing its Kuanping and BYP (421,000 oz gold measured and indicated and 110,000 oz gold inferred) initiatives with an eye on transformational discoveries, while processing at the GC Mine carries on at a rate of over 300,000 tonnes per year.

The company forecasts FY 2024 production at 6.8-7.2 Moz silver, 4,400-5,500 ounces of gold, 70.5-73.8 million lbs of lead, and 27.7-29.7 million lbs of zinc. This represents anticipated increases of 3%-8% in silver, 0%-25% in gold, 4%-8% in lead, and 18%-26% in zinc compared to FY 2023.

This progress coincides with a gold-silver ratio near 80:1 – a clear silver value signal compared to the historical average of 15:1 – amid persistently high global inflation and a renewed sense of these metals as non-fiat hedges. The company’s exposure to base metals, for its part, acts as a complementary industrial counterweight to silver and gold’s currency applications thanks to their vast need and/or short supply, especially for the green energy revolution.

While many miners require hopes and prayers to become profitable, Silvercorp has provided us with a wealth of results that substantiate management’s ability to identify prospective deposits and develop them into cash producers for stakeholders and future growth.

It’s not often that such a clear under-the-radar opportunity reveals itself to be hiding in plain sight. The time to sharpen your research process and dive in is now.

For more information, visit www.silvercorpmetals.com.

This is sponsored content issued on behalf of Silvercorp Metals, please see full disclaimer here.