With the commodity cycle gaining positive momentum after over a decade of stagnant returns, investors are keen on allocating into bright spots in the space.

The sources of this momentum include:

- The Russia-Ukraine war, which has tightened oil, grain and metals supply chains, and exacerbated negative market sentiment amid fears of a global recession, nudging investors toward commodities for capital preservation

- The post-pandemic surge in demand, which is placing a premium on a wide variety of industrial inputs, precious and base metals chief among them

- The acceleration of the transition from fossil fuels to electric power, which requires exponential growth in energy metal production including silver, copper and zinc

- The highest inflation rates in decades, which have set the stage for explorers and producers to increase cash flows and expedite the securing of domestic supplies

Among mineral explorers positioned to capitalize on commodities’ return to the spotlight, one company worth a deeper look is Alianza Minerals (TSXV:ANZ, OTCQB:TARSF), a discovery-focused microcap issuer that balances self-funding with joint development agreements to maximize discovery opportunities, mitigate risk, keep costs low, and create flexibility to make acquisitions regardless of market conditions.

The company’s silver, gold and base metal properties span a diversity of locations in Yukon, Nevada and Colorado, as well as four royalties in Mexico and Peru, all of which were selected based on political stability, underexplored land packages and tier-1 mineral endowments.

Led by President and CEO, Jason Weber, Alianza’s exploration strategy is backed by a team of experts in early-stage projects and boots-on-the-ground fieldwork to accurately capture geologic characteristics.

“As a team, we recognize the weights of our evidence,” commented Weber. “We take our observations and results and let them guide us, instead of just looking for evidence to support our exploration thesis. When we explore, we’re trying to disprove our ideas. If the ideas remain sound after each campaign, we keep going. That’s a bit different from other approaches.”

With that, we’ll now examine recent developments at Alianza’s properties to offer a more focused sense of the investment opportunity at hand.

Haldane Silver Project

Alianza’s flagship 8,579-ha Haldane Silver Project is located in Yukon’s Keno Hill Mining District, which is one of the world’s highest-grade silver camps. Production at Keno Hill exceeded 217 Moz of silver from 1913-1989 at an average of 1,149 g/t Ag (37 oz/t), 5.62 % Pb and 3.14 % Zn.

Haldane is underexplored and road-accessible with discovery potential at depth, on strike and in new high-grade silver vein systems, including room to double the known strike length of 12 km.

West Fault Target

Drilling in 2020 at Haldane’s West Fault Target yielded 1.78 m averaging 818 g/t Ag, 3.47 % Pb and 1.03 % Zn, with 2021 follow-up drilling reaching as high as 1.26 m averaging 3,267 g/t Ag, 5.80 % Pb and 7.02 % Zn.

West Fault is characterized by wide, high-grade silver veins and mineralization open to depth and on strike, with veins occurring in two structural levels. To date, Alianza has identified silver vein mineralization at West Fault over an area of 100 m x 90 m.

Middlecoff Zone

Haldane’s Middlecoff Zone offers 235 m of strike on a mineralized structure and historic production of 24.7 t of 3,102 g/t Ag and 59 % Pb (1918-19). The company plans to drill test the zone at depth and for a southern extension.

Bighorn

Another prospective area at Haldane, the Bighorn Zone, yielded multiple vein structures and Keno-style mineralization in the company’s first drill hole (2019), testing a soil geochemical anomaly, including 2.35 m of 125 g/t Ag, 4.39 % Pb and 0.09 % Zn.

Ongoing exploration work at Haldane

Motivated by these encouraging results, Alianza initiated a mapping, prospecting and trenching program at Haldane in September to bring immature targets to the drill-ready stage. The company is investigating recently defined targets and extensions of historical high-grade silver production.

Targets include four areas with potential Keno-style carbonate-silver sulphide vein mineralization similar to Middlecoff, West Fault, the nearby Keno Hill Mine, and other strategic Keno Hill deposits recently purchased by Hecla Mining, the largest silver producer in the U.S.

Target areas

- Sundown, a large gold-arsenic soil geochemical anomaly with some silver and antimony

- The 900-m-long Bighorn silver-lead anomaly, with exploration to optimize for a follow-up to the initial 2019 drill hole

- Bighorn East, where crews will investigate anomalous soil results between Middlecoff and Bighorn East

- The 400 m x 300 m Sb-Au-As-Bi Ross West anomaly, which is 1,800 m west of the original Ross soil geochemical anomaly initially tested in 2019

Targets may also be prospective for gold mineralization, with other Keno District players, such as Banyan Gold, having recently identified gold deposits in the area.

Stateline Property

Alianza’s news flow has also been active with its joint venture initiatives as part of the SW U.S. Copper Alliance alongside Cloudbreak Discovery (LSE:CDL), a diversified natural resource project generator in Canada and the U.S.

Under the Alliance, which began in June 2021, either Alianza or Cloudbreak can introduce projects located in the southwestern U.S. Upon acceptance, ownership is split 50/50, with 40 % of funding provided by the introducing partner. This arrangement will run for an initial two-year term, which can be extended for an additional two years.

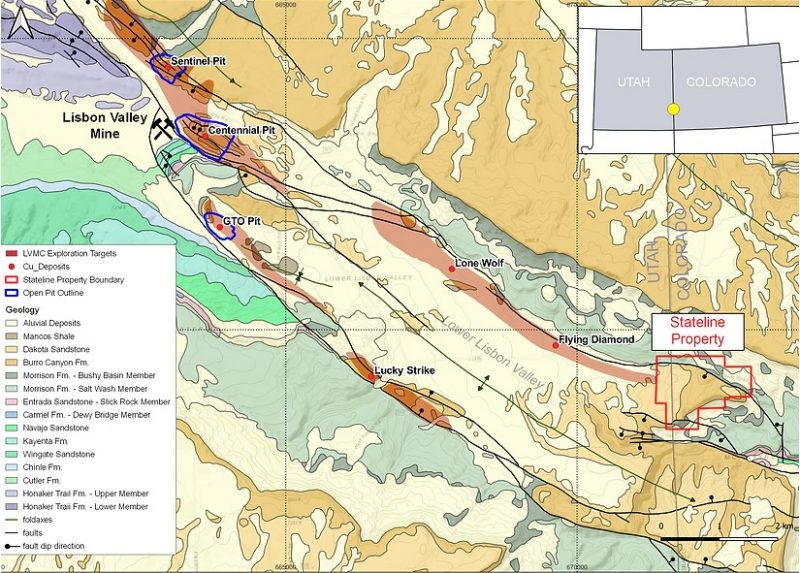

Last month, the Alliance received TSXV approval to option the Stateline Property – located on the Utah/Colorado state line – to Allied Copper (TSXV:CPR), a Vancouver-based mineral exploration company focused on acquiring and developing copper and gold assets in the Western U.S.

Stateline is prospective for sediment-hosted copper mineralization and has yielded historical results of 1.6 % Cu and 1.7 g/t Ag, as well as 0.45 % Cu and 2.1 g/t Ag. It is also proximal and on trend with the operating copper-rich Lisbon Valley Mine.

Allied may earn 100 % ownership of Stateline, subject to a 2 % net smelter royalty (NSR), by making the following payments over a four-year term:

- Aggregate cash payments of $315,000

- Issuance of 4,250,000 common shares

- Exploration expenditures of $3,750,000

- Issuance, subject to certain milestones, of an additional 1,500,000 shares and 1,500,000 warrants

Klondike Copper Property

Colorado’s Klondike Property, another Alliance project, has also been optioned to Allied with a planned 1,000 m drilling program recently completed in September of 2022.

Klondike is road-accessible year-round and offers favourable stratigraphy known to host sediment-hosted copper deposits in the Paradox Copper Belt, similar to the Lisbon Valley Mining Complex 50 km to the northwest.

The program, fully funded by Allied, was an initial test of three multi-km copper targets at the West Graben (6.23 % Cu, 127 g/t Ag), East Graben (2.8 % Cu, 37.8 g/t Ag) and Northeast faults, with results tentatively slated for Q4 2022. Phase one included 5 of the 12 highest-priority drill holes to a maximum depth of 250 m.

Access construction between pads at Northeast Fault revealed numerous new occurrences of copper-oxide mineralization in sandstone. Alianza identified this target during a 2021 reconnaissance program, with sampling returning 1.56 % Cu and 1.4 g/t Ag over 4.6 m.

In addition to Klondike’s high-grade potential, its disseminated copper-silver mineralization may be amenable to modern open-pit mining (solvent extraction electrowinning), again similar to Lisbon Valley.

Allied’s option on Klondike will see it earn full ownership over a four-year period by:

- Funding $4,750,000 in exploration

- Issuing 7,000,000 shares

- Paying $400,000 to the Alliance

- An additional 6,000,000 Allied warrants are payable upon reaching certain milestones

The Alliance will hold a 2 % NSR, half of which Allied may purchase for $1,500,000.

Future catalysts

Toward the end of this year and into the first half of 2023, investors should keep a close eye on results from Haldane and Klondike and initial field work and drilling from Stateline as Alianza works to define the size and tenor of mineralization.

The company’s Tim Project in Yukon (320 g/t Ag and 9.12 % Pb over 4 m (1988)) is also in the final stages of permitting, which will allow partner Coeur Mining to begin work in early 2023 on the silver, lead and zinc property.

And when it comes to funding ongoing exploration, Weber is confident in the support of new and existing partners, and long-term shareholders as significant results are announced, metals markets take notice, and news from its new neighbour, Hecla, unlocks value in the Keno Hill District.

Investment case

Alianza’s stock, currently at an all-time low, is far from worrying for Weber, who believes the company is undervalued and primed to surge upon the unveiling of an economic discovery.

“I’m actually really excited about how things look,” he stated. “We’ll have drilling news flow that will support us as things come together, both in the short term and through 2023.”

While metals companies have not been immune to rising interest rates and growing recessionary fears, Weber forecasts that prices will rise again in 2023, after year-end tax selling, as investors realize that bearish views were already priced into the market.

If his thesis comes to pass, it will likely coincide with results from Alianza’s active projects, positioning the company to generate shareholder value and establish tangible market recognition moving forward.

From a long-term perspective, the CEO identifies a potential new silver discovery at Haldane as one of Alianza’s strongest advantages among competitors.

“If the market turns around like we think it will,” he said, “we’re in the early stages of a silver discovery in a known silver district that is now going to be even more highly recognized. I think that’s primo exposure for a silver investor.”

He also recognizes an enticing opportunity in the company’s copper and zinc exposure, which, along with silver, stands to benefit from the ongoing supply crunch in energy metals underlying the electrification revolution.

“There are going to be refiners beating down producers’ doors to refine the metals,” Weber said, “and they’re in turn going to be beating down the doors of companies like us who are going to make those early-stage discoveries.”

Equipped with standout properties in line with macro demand, a reasoned, data-centric exploration strategy, and a team unafraid to get their hands dirty to see it through, Alianza boasts a crystal-clear investment thesis to ride through current market pessimism into the next stage of the clean energy transition.

To learn more about Alianza Minerals, visit www.alianzaminerals.com.

FULL DISCLOSURE: This is a paid article by The Market Herald.