- The private placement consisted of up to 57,645,295 units priced at $0.085 per unit

- Gross proceeds totalled $4,899,850

- Proceeds will be used for the development of a number of ongoing projects, along with general working capital

- Anfield Energy is a uranium and vanadium development and production company

- Anfield Energy (AEC) is up 11.36 per cent, trading at C$0.122 per share at 3:23 pm ET

Anfield Energy (AEC) has closed its upsized, non-brokered, private placement.

The private placement consisted of up to 57,645,295 units priced at $0.085 per unit. Gross proceeds from the offering totalled $4,899,850.

Each unit consists of one common share and one share purchase warrant. Each warrant entitles the holder to purchase an additional common share at a price of $0.13 for a period of 24 months.

The company paid $271,292 and issued 3,156,671 warrants to certain arms-length finders who assisted in introducing subscribers.

All securities issued are subject to a hold period expiring on September 15, 2021.

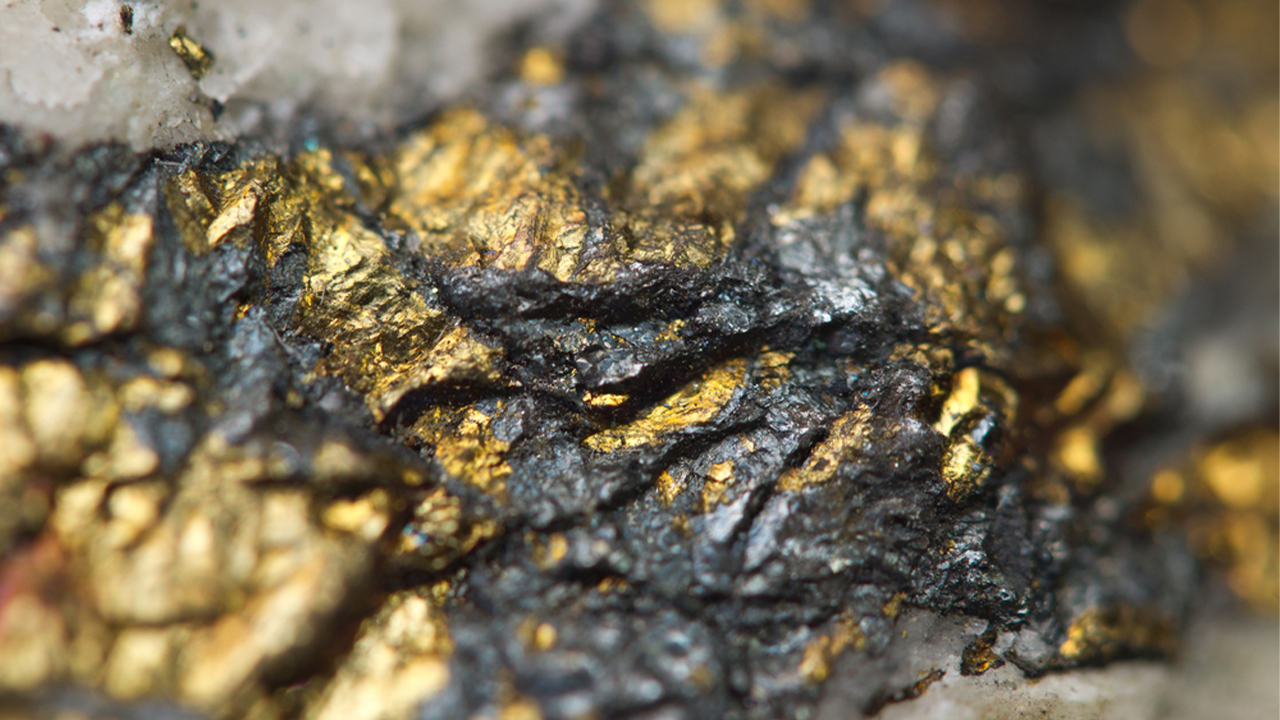

Proceeds will be used for the development of the West Slope vanadium/uranium properties, the Charlie Project and other Wyoming-based ISR projects, the Newsboy Gold Project, property-related costs, and general working capital.

The offering included subscriptions from directors and officers of the company for an aggregate of 4,250,000 units.

Anfield Energy is a uranium and vanadium development and production company engaged in mineral exploration, development, and production.

Anfield Energy (AEC) is up 11.36 per cent, trading at C$0.122 per share at 3:23 pm ET.